The HomeEquity Bank Note

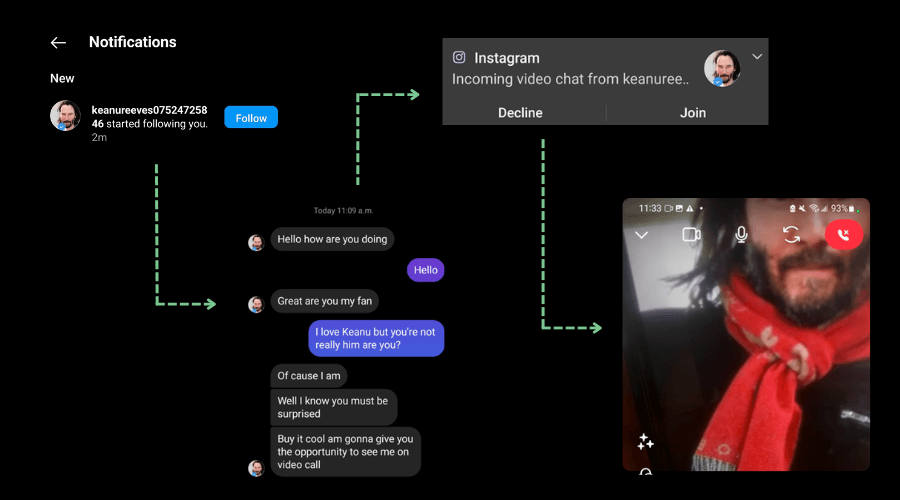

Last year, I got a message from someone claiming to be Canadian movie star Keanu Reeves. After exchanging messages with my Keanu impersonator, I decided to take a video call for research. Though the voice wasn’t right, the scammer’s technology generated a video of Keanu Reeves in real-time that was quite convincing. I didn’t believe Keanu Reeves was reaching out for a date, but I could see just how easy it would be to make that mistake The Canadian Anti-Fraud Centre (CAFC) reported that it received fraud and cybercrime reports totaling $530 million in victim losses in 2022, up 40 per cent from the year before. We’re living in a world where almost everyone can access technology to create convincing audio and video impersonating anybody from sitting heads of state to celebrities

Staying fraud-smart is especially important for Canadians aged 55 and up. More than half of this demographic (52%) report being the target of an online scam in the past, and over a third (36%) have fallen victim to a scam. Canadians 55 and up are targeted by scammers for two main reasons: the perception they aren’t technologically savvy, and that they’re inherently trusting of others – vulnerabilities that can be all-too attractive to online fraudsters. And when you consider the following, that a staggering 12,252 online frauds totaling $75.5 million have already been reported in 2022, and a projected 60% of people over 45 will receive fraudulent emails by the end of this year, it certainly makes good sense to stay informed.

First, Mansbridge asked Ranson to describe what aging in place means. “That’s easy,” replied Ranson. “You get to stay in your house for as long as you wish.” Mansbridge suggested that most homes in Canada were built for more than two people, but now it appears that older Canadians want to stay in that same home. Ranson replied by saying, “I love my house. When my kids get married, I think about hosting receptions for them. Our home will always be where they can come back for family events, birthdays, Christmas, and other holidays.

At HomeEquity Bank, when we say we’re here to support people and communities, we mean it, and we’ll continue to do so in any way we can. That’s why we’ve made a $25,000 donation to the Canadian Red Cross’ Ukraine Humanitarian Crisis Appeal, in support of those affected by ongoing events in Ukraine and bordering countries.

Ziomecki has worked at HomeEquity Bank for eight years, expertly raising the profile of the company. She has helped to make reverse mortgages a trusted option for older Canadians and their families. She’s deeply committed to how a CHIP Reverse Mortgage can make life more prosperous, safer and more enjoyable for Canadians 55 years and older. She describes writing her book as an act of love. Home Run offers expert advice and reliable information to those looking for a secure, comfortable and gratifying way to age in place.

Since the Covid crisis in long-term care, our ideas of how best to age have altered dramatically. In fact, 93 percent of Canadians are now reporting that they plan to remain in their own homes for as long as possible, but we may be financially unprepared for a safe and comfortable retirement at home. The big question facing us is how to make aging in place a reality. During a recent webinar hosted by the Empire Club of Canada and sponsored by HomeEquity Bank, journalist and author Peter Mansbridge moderated a panel of red-letter experts on aging. It featured Bonnie-Jeanne MacDonald, Director of Financial Security Research at the National Institute on Ageing, Dr. Samir K. Sinha, Director of Geriatrics at Sinai Health System and the University Health Network and Laura Tamblyn Watts, CEO at CanAge.

Each commercial finish with the same inspiring comment: “Retire in the home you love, with a CHIP Reverse Mortgage.” The commercials use humour to get across some serious points: Canadians are living longer, they’re not frail and dependent, Canadian retirees know their own minds and they won’t be told what to do, and finally, that downsizing isn’t for everyone.

In this interview, HomeEquity’s Executive Vice-president of Marketing Yvonne Ziomecki talks about her new book, Home Run: the Reverse Mortgage Advantage, (co-written with HomeEquity CEO Steven Ranson) her family, and her thoughts about shaping a successful retirement.

In this interview, HomeEquity Bank’s CEO Steven Ranson discusses his new book, Home Run: the Reverse Mortgage Advantage, (co-written with Yvonne Ziomecki, Executive Vice-president Marketing). Ranson has been with the company since 1997, growing HomeEquity’s portfolio from $100-million in 1997 to more than $4-billion today.

Four years ago, Kurt Browning — the beloved Canadian sports icon — became an official spokesperson for HomeEquity Bank.