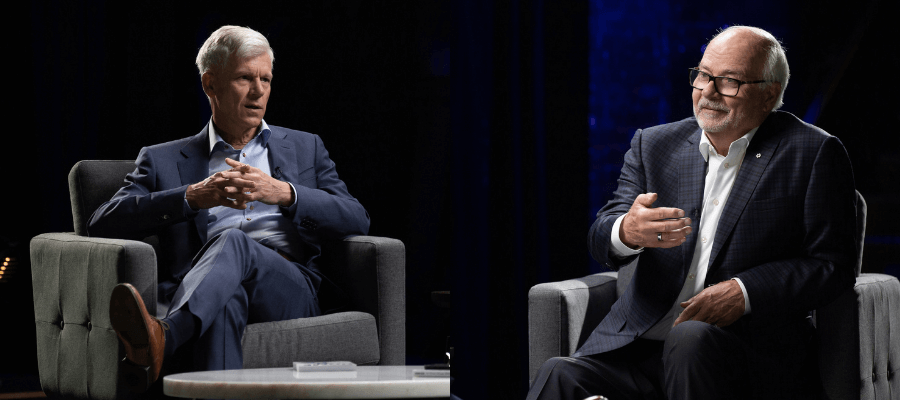

HomeEquity Bank recently launched a new campaign of commercials that interrupt the stereotypes of older Canadians and their perceived need for downsizing.

The set of three spots playfully shows how younger relatives have preconceived notions of what’s good for their parents and in-laws, without actually consulting them on how they feel. The first spot, “Consultation” shows a retired couple’s hilarious reaction to their son-in-law’s suggestion that they move to a retirement community.

The second commercial, “Granddaughter” shows a grandmother’s shock when her granddaughter informs her that her mommy thinks she should move to a place where other “old people” live. The final spot, “Sore Back” is a cheeky story of a daughter completely misunderstanding the reason for her father’s sore back while trying to force the “benefits” of downsizing on her parents.

There is also a series of “Conversation Stoppers with Doris”, the feisty grandmother from the “Granddaughter” commercial. In each one, Doris gives a curt and witty reply to comments such as, “Maybe you’d prefer living in a retirement community,” and “Isn’t city life a bit much at your age?” Doris’s hilarious replies make it very clear that she is happy staying where she is, in the home she loves.

Each commercial finishes with the same inspiring comment: “Retire in the home you love, with a CHIP Reverse Mortgage.” The commercials use humour to get across some serious points: Canadians are living longer, they’re not frail and dependent, Canadian retirees know their own minds and they won’t be told what to do, and finally, that downsizing isn’t for everyone.

Canadian retirees want to stay in their home, thank you very much

A study of Canadian retirees in major cities discovered that 86% of them are keen on aging in place and want to stay in their home for as long as possible, and there are some very good reasons why. However, according to Ipsos survey results, 76% of Canadian homeowners 55+ sometimes feel pressure to sell their homes.

Some years ago, the benefits of downsizing meant that retirees could cash in their equity by selling their home, moving into a much cheaper one and using the difference to finance their retirement. The benefits of downsizing were particularly attractive for retirees who lived in the city and were willing to move to a rural town with inexpensive housing.

This has all changed. Since the COVID-19 pandemic, the Canadian real estate market has gone through a big transformation. City dwellers have been increasingly moving out of expensive areas and buying up larger properties in towns often several hours away. These real estate trends have led to a large increase in housing prices in previously affordable areas.

Across the country, real estate trends show that the average price for a home increased by 25% between February 2020 and February 2021. However, some locations, particularly more rural and previously affordable towns, are seeing increases of up to 50%. In one extreme case, the small Ontario town of Bancroft saw an annual increase in home prices of 86.6%.

A downsizing plan gone wrong

The Globe and Mail recently ran a story about a retired Ontario woman who sold her Toronto home, with a view to buying a much cheaper one, rather than aging in place. Her plan was to buy one in a quiet community near her relatives, for around $300,000. This would leave her with enough money to retire comfortably.

Unfortunately, she reckoned she realized belatedly that she may have to spend as much as $600,000 to buy a suitable home. This considerably reduced the financial benefits of downsizing.

Downsizing can also be expensive. You can read about the range of costs involved, which include:

- Realtor commission (up to 6% of the selling price)

- Title insurance and legal fees

- Land transfer tax (this can be well over $10,000, depending on where you live)

- Moving expenses

- New furniture for a smaller home

- Condo fees

And a Toronto retiree describes how her downsizing plan to move into a condo became a nightmare, forcing her to eventually move back into a house.

The other advantages of aging in place

The crazy-hot Canadian real estate market is not the only reason why Canadians want to stay in their home in retirement. The COVID-19 pandemic showed Canadian retirees the safety benefits of aging in place compared to living in a retirement home.

There are also emotional reasons why you might want to stay in your home in retirement:

- Your home may contain many valuable memories of your loved ones

- You can stay close to friends and family (this becomes even more important if you develop mobility issues)

- Canadians are living longer and want to keep their independence for as long as possible

- You remain in a neighbourhood you know and love

- You don’t have to completely rebuild your social circle

- You don’t want to move away from your favourite stores, restaurants and place of worship

- You get to stay in the home you love

Retirement homes and downsizing versus a reverse mortgage

While we’ve seen that 86% of Canadian retirees are keen on aging in place, 31% of them need to tap into their home’s equity to retire comfortably. Given that the Canadian real estate market has made downsizing financially unrealistic in many places, and many Canadians simply don’t want to move into a retirement community, what options are left?

A reverse mortgage could be the ideal solution. It allows for aging in place while still tapping into your home’s equity. Homeowners aged 55-plus can borrow up to 55% of the appraised value of their home. Plus, you qualify based on your age, your home’s value and its location, rather than your income and credit score.

This avoids a key disadvantage of downsizing versus a reverse mortgage: moving out of the home you love. Another disadvantage of downsizing versus a reverse mortgage is having to spend tens of thousands of dollars to move. With a reverse mortgage, you keep all of that money.

One final and crucial advantage of a reverse mortgage is that you don’t have to make any regular mortgage payments. You only have to pay back what you owe when you sell your home or move out, so it only has a positive impact on your retirement income.

Call us at 1-866-522-2447 to find out how much you could borrow to ensure you have the retirement you want, while you continue aging in place, in the home that you love.