By Vivianne Gauci

The Canadian Anti-Fraud Centre (CAFC) reported that it received fraud and cybercrime reports totaling $530 million in victim losses in 2022, up 40 per cent from the year before.

This number probably isn’t very surprising to anyone who spends time online. It’s harder than ever to know what’s real. We’re living in a world where almost everyone can access technology to create convincing audio and video impersonating anybody from sitting heads of state to celebrities. It means online scams are common and more sophisticated than ever.

Canadians were the recipients of nearly 60% of all phishing attacks globally in 2020, and one in every three Canadians 55 and better report they’ve been scammed. But there’s probably more. So many of us feel ashamed for have been a “mark” that we don’t want to talk about it. That’s why I wanted to share my experience.

Romance Scams: Xoxo, Deepfake Keanu Reeves Scam

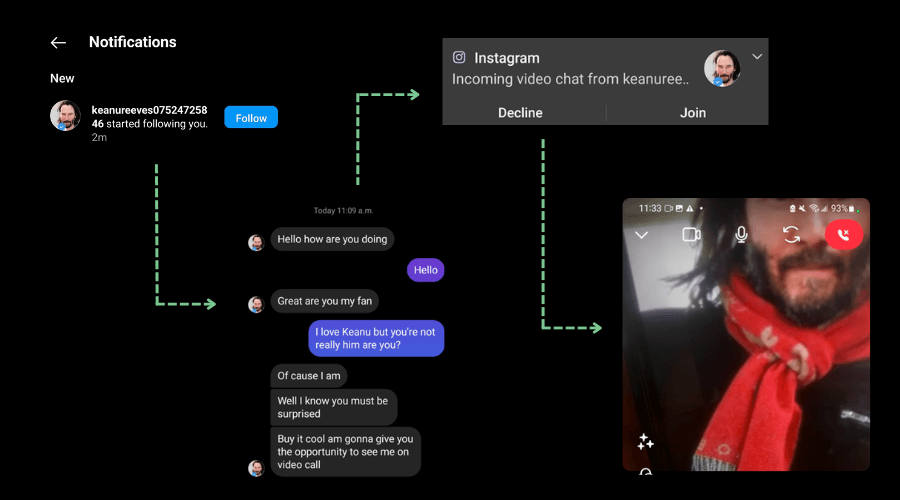

Last year, I got a message from someone claiming to be Canadian movie star Keanu Reeves.

I’m familiar with the romance scam approach. Typically, your “suitor,” who might be impersonating a celebrity, will move quickly so you don’t have time to think critically, reflect or ask questions. Suddenly, they’re urgently making a request for money.

After exchanging messages with my Keanu impersonator, I decided to take a video call to gain insights that would help protect other Canadians who may find themselves in a similar situation. Though the voice wasn’t right, the scammer’s technology generated a video of Keanu Reeves in real-time that was quite convincing. With Canadians 55+ the target of an increasing number of scams, we wanted to empower and equip Canadians 55+ with the tools they need to protect themselves and be on guard against online fraud has become more important than ever.

Although, I didn’t believe Keanu Reeves was actually reaching out to me online, I could see just how easy it would be to make that mistake. This technology is easily and readily available and helps scammers disarm and distract their targets.

How scams are diversifying online and offline

Romance Scams which accounted for $59 million in losses in 2022, are only one type of a variety of scams we’re seeing on the rise in Canada.

Canadians are living their lives online more since the pandemic and, as a result, are increasingly impacted by false offers of tech support, which is categorized as the Tech Support Scam. These can take the form of an unfamiliar pop-up on your internet browser urging you to call a helpline, or even an unsolicited phone call offering to help you with a vague issue. We’ve become reliant on our devices to keep ourselves connected and take care of important things in our lives, and scammers prey on this knowledge when we might be at our most vulnerable.

But it doesn’t stop once you go offline. More and more, Canadians are falling victim to stolen identities where fraudsters have gone as far as purchasing homes in their names, leaving them on the hook to deal with the fallout. These cases of identity fraud are often called Real Estate Scams. With scams becoming more commonplace and sophisticated than ever, it’s crucial that Canadians know the signs and take measures to better protect themselves.

How you can protect yourself from scams

Moving too quickly in a romantic scenario should always raise some flags—but even more so if your supposed partner is a celebrity. Make sure you give yourself time to stop and think, even mention any new online romances to a friend or loved one. They might lead you to ask: Why would Keanu Reeves need me to send him money? Or, they might have their own similar experience to share.

While the approaches may look different, scams that happen online or over the phone follow similar patterns.

Things to look out for are:

- A sense of urgency or pressure to move quickly

- An unsolicited request for help

- An offer that seems almost too good-to-be-true

- A vague threat of harm to you or your family—financially or otherwise

On or offline, it’s important to protect your personal banking and sensitive identifying information. Sometimes we forget about more traditional forms of fraud while trying to stay safe on our screens, but neither identity theft nor real estate fraud are new. It’s still important to shred or destroy documents with your sensitive data before you throw them away.

We should see sharing our own experiences with scams as a means of better protecting us all. That means breaking down the stigma that comes with being the target of a scam. The more scams we can recognize and share with others, the less successful scams will be.