What will you call home in your retirement years?

Retirement is an exciting dream for many of us…when we are in our 40s or 50s and at the zenith of our careers. As we get closer to the realization of this dream, we have questions. A series of important, complex questions, with unfortunately not so simple answers. For example, you may start to think about:

- Senior housing – should I visit some senior retirement communities or nursing homes; what are the different housing options for the elderly (once I do get there)?

- Age-related health issues – will I need personal assistance and medical care; and if it came to it, what is the cost of living in a nursing home?

- Community and leisure activities – what are some of the best places to retire in Canada? Would relocating actually provide a better life in retirement?

- Financial considerations – what is the cost of retirement homes in Ontario and in other Canadian provinces?

- And so on…

Gone are the days when retirement was just a “short phase” of life. A global study across 200 countries ranks Canada at number 11 for its average life expectancy of 82.5 years. And this number continues to increase with time. More and more Canadian men and women are living well beyond their retirement age and making radically different lifestyle choices compared to previous generations. Whether it is food, fashion, travel, housing or financial planning, Canadian seniors are finding newer ways to make their retirement more comfortable and enjoyable.

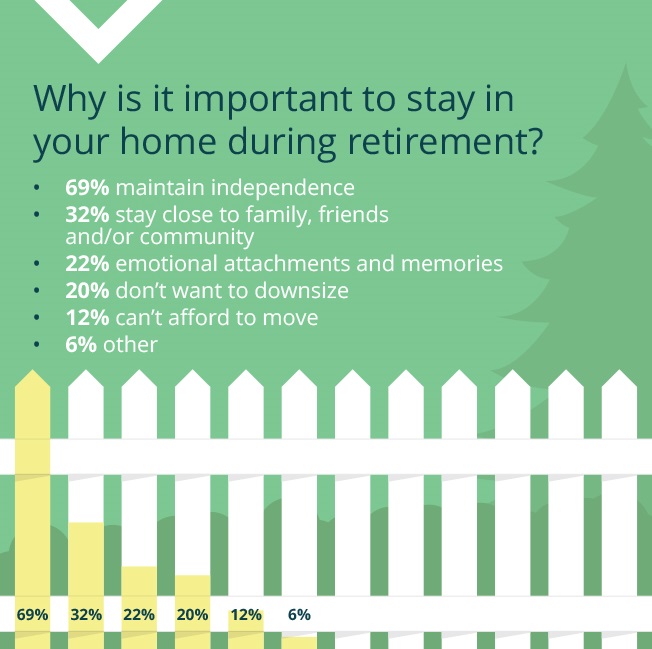

When it comes to housing, the vast majority of seniors prefer to stay in their own homes. However, at times, your family situation, health needs, or lack of sufficient retirement funds may compel you to look at alternate senior housing arrangements.

- Are you inching closer to your retirement years and looking to make a decision about your living options in Canada?

- Have you already retired and are trying to compare the cost and viability of senior housing options versus staying in your own home?

- Do you have an elderly family member in need of independent retirement living, assisted living or senior care?

No matter what your reasons for exploring the world of senior housing, read on to know more about retirement housing options for seniors in Canada.

When planning where you will live in your retirement, you will also have to consider your finances from day-to-day expenses, family needs, health care costs or lifestyle expenses. You can support your finances in retirement without moving out or selling your home.

Low income Housing options for Canadian senior

From independent and community living, to assisted living and residential care, there are several housing options for Canadian seniors. Here’s a look at some of the possibilities.

-

- Staying and aging at home: If you are an independent, healthy senior, with enough savings for your retirement years, staying and aging at home is a no-brainer. There is no better place to call home than the one in which you have spent years (maybe even decades) raising a family and living with your loved ones. If you meet the criteria of a low-income senior, the provincial and federal governments run several assistance programs for your benefit.

- Safe occupancy: Every province has its own version of a home adaptation program. Through these grants, low-income seniors can carry out repairs and modifications to increase their home’s safety and accessibility, particularly for age-related challenges or diminished physical abilities. For example, you could get financial assistance to add chair lifts, handrails, bathtub grab bars, or carry out electrical, plumbing, heating or structural repairs that make your home safe for occupancy.

- Tax credits and write-offs: Some provincial programs offer credits, deferrals or full write-offs on various land or property taxes that you owe the government.

- Emergencies and other assistance: From repairs for sudden, unexpected issues with heating, chimneys, vents, roofs, etc., to financial aid for utility bills to prevent disconnection, there are various emergency grants available for low-income seniors. Additionally, there are assistance programs that can help you increase your home’s energy efficiency, reduce your utility bills, get aid for snow removal, and address the minor repairs and preventive maintenance needs of your home.

- Secondary suites (granny suites): An independent secondary dwelling either attached to the principal dwelling or in a separate structure on the same property can have multi-fold advantages.

- A family that wishes to have their elderly family members stay on the same premises can look at building in-law suites with a full kitchen, bath and separate entrance – also known as garden suites or granny suites

- Seniors who stay at home independently can gain income security and financial independence by building secondary suites and renting them out. Low-income seniors could also apply for government grants for this purpose

- Staying and aging at home: If you are an independent, healthy senior, with enough savings for your retirement years, staying and aging at home is a no-brainer. There is no better place to call home than the one in which you have spent years (maybe even decades) raising a family and living with your loved ones. If you meet the criteria of a low-income senior, the provincial and federal governments run several assistance programs for your benefit.

- Downsizing or rightsizing (independent retirement living): If you currently live in a sprawling, suburban home that is too large or expensive to maintain, or unsuitable for your changing health and accessibility needs, consider downsizing or ‘rightsizing’. The underlying assumption here is that you are relatively active and do not need assistance for daily tasks such as eating, grooming, or personal care. Based on your monthly budget and preferences, you can explore these independent retirement living options:

- Co-housing: Share your home with a friend or family member to cut down your expenses and jointly own the responsibility of daily household chores.

- Co-operative housing: Enjoy accommodation in a seniors-only housing complex in return for sharing the maintenance cost or other daily tasks.

- Retirement homes and communities: Senior retirement communities are designed to promote independent living, while also addressing the recreational and support needs of older adults. Choose from luxury properties with modern amenities, gourmet dining and golf courses, or modest accommodation in condominium complexes. Most retirement homes offer:

- One to two-bedroom independent units in a community setting at convenient locations

- Proximity to retail shops, libraries, swimming pools, salons and fitness centres

- Add-on services such as, housekeeping, laundry, daily meals and private transportation (available in some senior communities)

- Assisted living: If you need some assistance with your daily tasks, such as eating, personal care, grooming, mobility or health care, you may want to look at assisted living accommodations such as:

- Supportive housing: Similar to retirement homes, supportive housing offers independent accommodation units, usually in a seniors-only community. While you pay the rent and living expenses, you have access to health care facilities and other personal support services at a reduced cost, or for free (if it is included in your overall accommodation fee). This includes:

- Housekeeping, laundry and meal services

- Assistance for medication management

- Transportation for personal appointments

- Support for bathing, grooming and other personal care

- Access to visiting or on-site health care professionals, including physicians, nurses and physiotherapists

- Residential care homes: These are more traditional and private compared to the large senior housing complexes. Residential care homes accommodate no more than 15 older adults at a time. In this arrangement, you can experience a more intimate, family-like environment, along with all the conveniences of assisted living.

- Supportive housing: Similar to retirement homes, supportive housing offers independent accommodation units, usually in a seniors-only community. While you pay the rent and living expenses, you have access to health care facilities and other personal support services at a reduced cost, or for free (if it is included in your overall accommodation fee). This includes:

- Long-term care homes: Seniors with conditions, such as dementia or Alzheimer’s require long-term assistance and care that is offered through nursing homes or memory care units. Similar to retirement homes, this housing option is usually funded by provincial governments for low-income seniors with demanding health care needs.

Funding your housing needs post-retirement: how much will it cost?

When you plan your retirement finances, you are likely to take into account your day-to-day expenses, family needs, health care costs and the expenses for your bucket list items or activities. However, in addition to these factors, you may also have to consider your housing requirements over the course of your lifetime. In the initial years post-retirement, you may be active, healthy and confident about independent living and self-sustenance. Maintaining your home and doing chores around the house may be a breeze. As the years go by, you may need additional support, care or nursing, all of which will come at a cost. Whether you choose in-home assistance or assisted living accommodation, here is a quick glance at how much you are likely to spend on it.

The indicative flat rate per month covers your accommodation, meals, amenities and services (the ones you choose), and the care or assistance that you will receive. Additionally, you may have to account for entrance fees, as well as deposits, which vary by the type of seniors’ accommodation and the province. Within the government-subsidized assisted living options, your rent is determined on the basis of your annual income. When you are exploring various senior retirement communities, remember to clarify all the one-time costs and payments involved.

Stay-at-home versus senior housing options: what will you choose?

While staying and aging in your own home has its advantages, it also can come with a substantial investment of time and effort, for the maintenance and upkeep of your property. Based on practical considerations, such as lifestyle preferences, health care needs, companionship and availability of funds, here’s a look at the pros and cons of age-at-home versus other senior housing options.

While there are pros and cons of both options, if you choose to stay at home after retirement and age in place in the home you have built many years of memories in, here are some ways to make it financially viable:

- Downsize: Stay in your own home, but one that is more manageable, maintenance-friendly, and suitable for your accessibility needs and age-related challenges. Invest the remaining proceeds (minus the costs that come with downsizing) from your previous home for a steady, post-retirement income stream.

- Build a secondary suite: Whether you qualify as a low-income senior for government grants, or you use your home equity, build a secondary suite and rent it out for long-term financial sustenance.

- Use your home equity to create supplementary income: Stay in your home and tap into its equity through the CHIP Reverse Mortgage® or a Home Equity Line of Credit (HELOC). Use this money to supplement the rest of your retirement funds. While a HELOC will allow you to borrow up to a pre-approved credit limit on an as-needed basis, a reverse mortgage can give you lump sum cash in hand, without affecting your other benefits, such as Old-Age Security (OAS) or Guaranteed Income Supplement (GIS).

If you have further questions about the various seniors housing options across Canada, or home financing arrangements for retired Canadians, we are happy to help.

Call us at 1-866-522-2447 now to find out how much tax-free cash you could qualify for the CHIP Reverse Mortgage or get your free reverse mortgage estimate now.