As the leading provider of the CHIP Reverse Mortgage in Canada, we are approached with many comments about our interest rates – from it being too high, to it eating up the value of your home. This article will answer your questions about our interest rates and clear up misconceptions that have long been assumed by many Canadians.

Interested to know CHIP Reverse Mortgage Rates? Click here to see HomeEquity Bank’s current rate sheet.

Clarifying misconceptions about Reverse mortgage

Here are some common misconceptions and the real answers about the interest rates of a CHIP Reverse Mortgage in Canada.

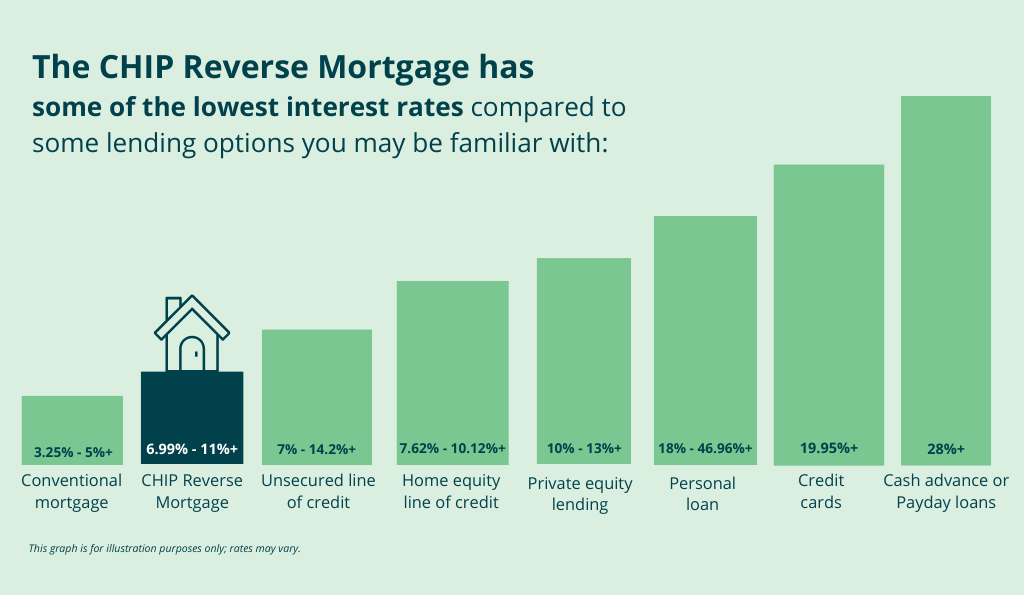

- The reverse mortgage has higher interest rates than that of a conventional mortgage – This is true, we provide a loan that requires no monthly mortgage payments, not even interest payments. Therefore, our interest rates are slightly higher than that of a conventional mortgage or home equity line of credit (HELOC).

- Interest is compounded – This may be true. However, HomeEquity Bank provides flexible options to make interest payments should the customer choose to do so.

- When the Bank of Canada releases a rise in interest rates, reverse mortgage interest rates will rise immediately as a result – This may or may not be true. HomeEquity Bank offers customers the choice of different fixed or variable terms. If the Bank of Canada raises variable interest rates, reverse mortgage rates may rise but our fixed rates may stay the same or even decrease.

- The compounded interest rate will cause me or my family to owe more than the value of the home when the loan is due – This is not true. A reverse mortgage, unlike most traditional mortgages in Canada, has a negative equity guarantee. This means that if the loan amount due is more than the sale amount of the property, HomeEquity Bank will cover the difference between the sale price and the loan amount (provided the homeowner has paid their home insurance, property tax and maintained the property in good condition). If these conditions are met, then the homeowners or their beneficiaries will never owe more than the fair market value of the home at the time it is sold.

- If I borrow a lump sum and the interest is compounded, then the bank basically owns my home by the time the loan is due – This is not true. Many people forget that they are still on title of the home and that even though the interest is compounded, the total value of your home can appreciate in value. Because of this, we have found that over 99% of our customers have money left over after repaying their loan.

A CHIP Reverse Mortgage is a product provided by HomeEquity Bank, a federally regulated bank in Canada with over 30 plus years in business. We are in the business of providing Canadians 55+ with a financial solution to help maintain or improve their standard of living. Canadians are living longer than ever before, yet their retirement savings don’t take their increased life expectancy into account. We provide a solution to help those who are house rich, cash poor access equity in their home to pay their bills, to pay for unexpected emergencies and to improve senior Canadians’ quality of life. Other loans such as HELOCs may be difficult to qualify for, and a reverse mortgage can be a great option for many older Canadians.

Learn how does a reverse mortgage work and find out how the CHIP Reverse Mortgage® can help boost your retirement income by calling us at 1-866-522-2447 or get your free reverse mortgage estimate now.