This is the first in our series on addressing reverse mortgage myths. Often, we are approached with false statements about reverse mortgages in Canada. Unfortunately, many Canadians make assumptions about the product or they hear about it from a friend who didn’t do their research about the product. Also, many Canadians assume Canadian reverse mortgages are the same as the products in the U.S., which are very different. The CHIP Reverse Mortgage is heavily regulated by governing bodies here in Canada and it is the only reverse mortgage product available. This series is here to address misconceptions and give you a clear understanding of the reverse mortgage product.

One of the most common misconceptions is that you will end up owing more than the property is worth, giving HomeEquity Bank ownership of your home. This statement is false; in fact, HomeEquity Bank has taken a number of measures to ensure the protection of your equity.

-

-

1. Retain ownership of your home

Just like with any other mortgage, your home is used to secure the loan which means that HomeEquity Bank is registered as a standard charge on title. You, as a customer DO NOT transfer ownership of your home to us. In fact, once it’s time to pay back the mortgage you or your heirs have the choice to settle the loan however you or they want. Selling the home is the most common option, but it is not mandatory.

-

2. Our conservative lending

At HomeEquity Bank we lend up to 55% of the value of the home depending on the age of the homeowner(s), property type and location of home. Homeowners 55+ are eligible for the product, but the younger you are, the less you will qualify for and the older you are, the more you will qualify for. The reason for this is we want to ensure that your reverse mortgage will never exceed the value of your home. Therefore, we lend less to someone who is 55 than to someone in their late 80’s.

-

3. Your home may appreciate in value

The total value of your home can appreciate in value, whereas the interest only accumulates on a small value (the borrowed amount) of the home. That is why over 99% of homeowners have money left over when their loan is repaid.

-

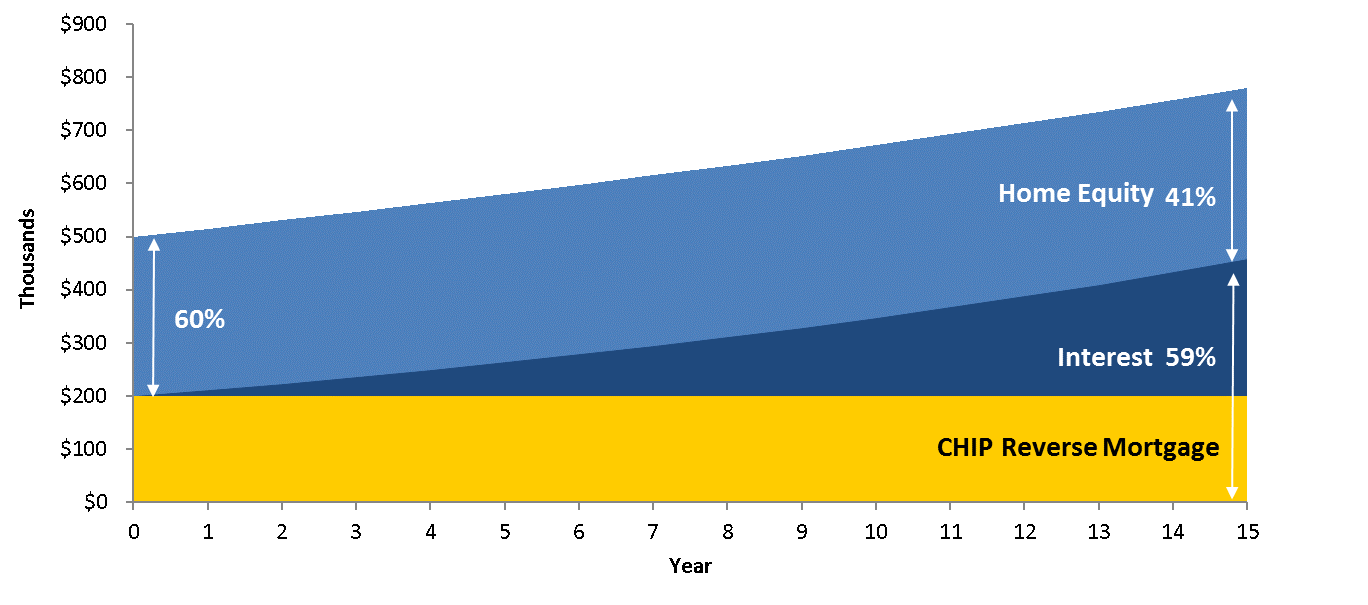

Home Equity Preservation – CHIP Reverse Mortgage

As you can see in the illustration below, a combination of conservative lending practices and even a modest level of home appreciation of 3%, allows for home equity preservation after you take out a CHIP Reverse Mortgage. In this example, a homeowner has a home with an appraised value of $500,000. The homeowner qualifies for $200,000 (40%) of the value of their home in a CHIP Reverse Mortgage (based on age, property type and location of home). The homeowner takes the CHIP loan for 15 years before they pass away. When the loan is to be settled, because there is a 3% home appreciation on the property, the home value is now $778,984. The principal plus interest add up to $457,288 and the estate is still left with $321,696 in home equity or 41% of the home value at time of sale.

Home Equity Preservation Graph – CHIP Reverse MortgageThe following graph is for Illustration purposes only

The illustration uses conservative values:

-

-

- Example based on the national price of Canadian homes of $500,000 (Average home price in Canada is $519,521 according to the CREA, February 2017)

- Example based on CHIP Reverse Mortgage advance of 40%

- Home appreciation of 3.00%. Average home appreciation is 7.16% annually. (Source: CREA, Canadian Real Estate Association 15-year national house appreciation average, February 2017). HomeEquity Bank makes no representations on future housing market performance.

- CHIP interest rate of 6.99%. The Annual Percentage Rate (APR) is 7.30%, which is the estimated cost of borrowing for 5 years expressed as an annual percentage. The APR includes interest and closing costs.

-

Negative equity guarantee

-

Many people assume that if your home equity depreciates in value at the time it is being sold, you or your heirs will end up owing more than the house is worth, causing your heirs to be financially penalized for being on the title of your home. However, this is not true. If the home depreciates in value and the loan amount due is more than the sale amount of the property, HomeEquity Bank will cover the difference between the sale price and the loan amount. We do require that customers keep their property taxes up to date, and maintain the condition of their home. If these conditions are met, you will never owe more than the fair market value of the home at the time it is sold.

The above measures ensure CHIP Reverse Mortgage customers will not be at risk of losing their home. In fact, a reverse mortgage can be a great solution that allows Canadian seniors to stay in their home for as long as they wish.

To find out how much money you can get for your home. Get a free CHIP Reverse Mortgage Estimate today.