Do you have any idea how much money you’ll need to save to retire in Canada? Half a million? A million? Two million?

According to a BMO survey, on average, Canadians think they’ll have to save $1.7 million for their retirement. But every retirement is different, depending on your unique needs, lifestyle and expenses. So, how much should you save for retirement and how do you work out how much is enough to retire your way?

Retirement savings rules to work out how much you need to retire

How much you need to retire in Canada is as individual as you are. It all depends on the kind of lifestyle and retirement that you want. Will you be travelling around the world or relaxing at home? Do you intend to work into your 70s or are you hoping to retire before you hit 60?

There are a number of theories for working out how much you need to save to retire comfortably:

- According to some investment advisors, 70% of your working income is how much to save to retire in Canada in comfort.

- Others believe you should have saved ten times your final salary by the time you retire

- The “4% rule” is another popular method for working out how much you need to retire in Canada comfortably. The idea is that you take out 4% of your savings for every year of retirement. For example, to be able to spend $40,000 a year in retirement, using the 4% rule, you would need to save $1,000,000

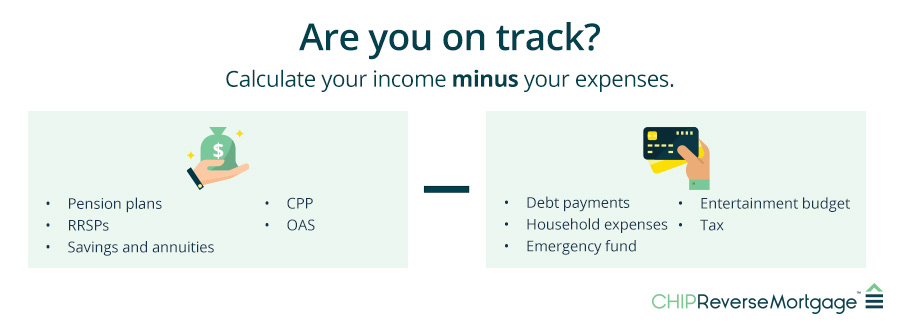

Start with calculating your retirement income

The first step in knowing how much you need to retire in Canada is to add up all income, including any company or private pension plans, personal or spousal RRSPs, other savings, and annuities. To get an accurate picture of how much you need to retire, be sure to also include payments from the government — specifically the Canada Pension Plan (CPP) and Old Age Security (OAS).

The amount you’ll receive from CPP will depend on how much you’ve contributed. The maximum is $1,433.00, but the average monthly payment in 2024 is only $808.14. Remember, you can increase the amount you receive by up to 42% if you wait until you’re 70. The maximum you’ll receive from OAS is $727.67 per month, but this amount depends on how long you’ve lived in Canada.

When you’re wondering, how much do I need to retire in Canada, and making retirement planning calculations, it’s important to consider the tax implications and impact on your future portfolio. You’ll probably pay income tax on any RRSP/RRIF withdrawals.

Working out your retirement expenses

The second step in calculating how much money you need to retire is knowing all of your retirement costs. Once you’ve retired, some of your expenses will be considerably lower. There will be no commuting costs and you won’t need to buy business clothes or other work-related expenses.

That being said, today more Canadians are carrying debt into retirement. From credit card debt to mortgages, retirees are faced with a list of expenses in life after work that can put pressure on them to sell their home, downsize or rent. This can make it much trickier to answer the question, how much do I need for retirement?

When looking at your retirement expenses, it’s important to:

- Include any debt or loan payments, including credit cards

- Calculate your usual household expenses, such as mortgage payments, utilities and municipal taxes

- Factor in an emergency fund and a realistic entertainment or discretionary spending budget

- Remember to set aside enough at the end of the year to pay taxes

Now is also the time to work out the expenses related to the type of retirement that you want. How much will it cost to travel or spend winters abroad, simply maintain your current home or do the renovations you always dreamed of? Consider your hobbies or whether you’ll want (or need) to give financial support to adult children or grandchildren. Include all the costs you’ll need for your ideal retirement. How much money you’ll need to retire will depend on how you answer these questions.

Calculate the difference: Money you need for retirement

The final step in knowing how much money you need to retire is to work out the difference between your annual income and expenses. For example, if your annual income is going to be $40,000 and your expenses are $80,000, you’ll need an extra $40,000 per year for a comfortable retirement.

Using the 4% rule (from the example above), how much you would need to save for retirement would be $1,000,000. If you find income and expense calculations to be too confusing, it’s a good idea to use a retirement calculator designed for Canada.

How to use a retirement calculator

Accurately working out compound interest, rates of return and inflation are beyond most people, so this is where retirement calculators come in handy. Be careful, though, as some retirement calculators are quite limited, plus it helps to use a retirement calculator specifically designed for Canada.

The Government of Canada’s retirement calculator is really useful. It allows you to enter RRSP and TFSA account information, as well as CPP and OAS details and income from company and private pensions.

This retirement savings calculator from BMO also takes into account your preferred investment style (the risk level you are willing to tolerate) and delivers a customized report detailing how much you will need to save to reach your retirement goal.

A Canadian retirement income calculator can be a really helpful tool to not only work out how much you need to save to retire, but also when you will be able to retire.

How much you need to retire: FAQs

How much do I need to retire in Canada at 60?

You would need to save considerably more than if you were to retire at 65. First of all, your savings would have to last an extra five years. Secondly, you wouldn’t be eligible to receive OAS (the earliest you can draw OAS is 65).

Thirdly, if you started drawing CPP at age 60, you would receive 36% less than the full amount, for the rest of your life, so you’d need even more savings. Use one of the retirement calculators mentioned earlier to find out how much to save for retirement at 60 and whether it’s feasible.

How much do I need to retire in Canada at 55?

Retiring at such a young age would require substantially larger savings than at 60. You would have no CPP or OAS income to begin with, your savings would have to last an extra five years, plus you would miss out on all those years of compound interest.

You would therefore need to start saving large monthly amounts from a fairly young age. Use a retirement calculator to find out how much to save for retirement at 55.

How much money do you need to retire with $100,000 a year income?

If you follow the 4% retirement savings rule mentioned earlier (where you withdraw 4% of your savings every year, to ensure your savings don’t run out) you would need to save $2.5 million to draw $100,000 in annual income.

How much does a couple need to retire in Canada?

Usually, a couple would need to collectively save less than a single person, because they split some costs (which would reduce their individual monthly expenses). Research in the US found that, individually, couples pay around 20% less in expenses than a single person.

When you calculate how much a couple needs to retire in Canada (using a retirement calculator), halve any shared expenses (such as mortgage payments, municipal taxes, utilities, home and car insurance, car payments, etc.) before coming to the final expenses total.

The retirement calculator would then work out how much less you would need to save for retirement because you are a couple.

How much does the average Canadian have in an RRSP at retirement?

While the average amount held in an RRSP is $144,613, for households aged 65 and up, that amount is $283,000 (including RRIFs).

When you look at how much the average Canadian household has saved for retirement in total (including all sources of savings), it is $514,800 for retirees.

How to save for retirement in Canada

Once your retirement planning calculator has worked out how much money you’ll need to retire, it’s time to work towards that goal. When you’re looking at how to save for retirement in Canada, the most important strategy is to start saving at an early age, so you can comfortably reach your retirement savings goals.

By starting early, you’ll benefit the most from compound interest (a process where you start earning interest on your interest). If, for example, you started saving $750 a month at age 30 and retired at 65, you could save just over $1 million.*

To save the same amount of money if you started at 40 years of age, however, those monthly amounts you would have to tuck away would skyrocket to $1,542. By delaying your start by just 10 years, you will have to make up for it by doubling the amount you save each month.

What if you can’t save enough for retirement?

After using a retirement savings calculator and working out how much money you need to save to retire in Canada, you may find that the final figure is simply out of reach. This can often happen if you started saving later in life. If that is the case, you do have several options. You could:

- Take a part-time job or rein in your retirement plans – this could mean less travelling or a later retirement

- Start up a business or rent out part of your home – either a room or a basement apartment

- Downsize, but this can be quite costly, plus the realtor fees and land transfer tax can take a considerable chunk out of your equity

Alternatively, if you’ve worked out how much money you need to retire and you’re coming up short, you could take out a CHIP Reverse Mortgage. This allows you to access up to 55%* of the value of your home without having to make any monthly mortgage payments. If you’re interested in seeing how much tax-free cash you could receive, try our reverse mortgage calculator now!

You get to stay in the home you love with an improved retirement income and only have to pay the loan if and when you decide to move or sell.

Find out how the CHIP Reverse Mortgage® can help boost your retirement income by calling us at 1-866-522-2447 or get your free reverse mortgage estimate now.