For many Canadians, aging in the right place means spending the golden years of retirement at home. However, staying in the home you love is closely tied to both your financial wellbeing and health, both of which are challenged by Canada’s shifting retirement landscape. It’s more important than ever for Canadians to explore how their most valuable asset – their home – can play a pivotal role in enhancing their financial security and health to enable them to age in the right place.

Canada is experiencing a rapid demographic transformation as a record number of Canadians reach retirement age and can also expect to live longer compared to previous generations. Given the mounting challenge, how can Canadians age in the right place?

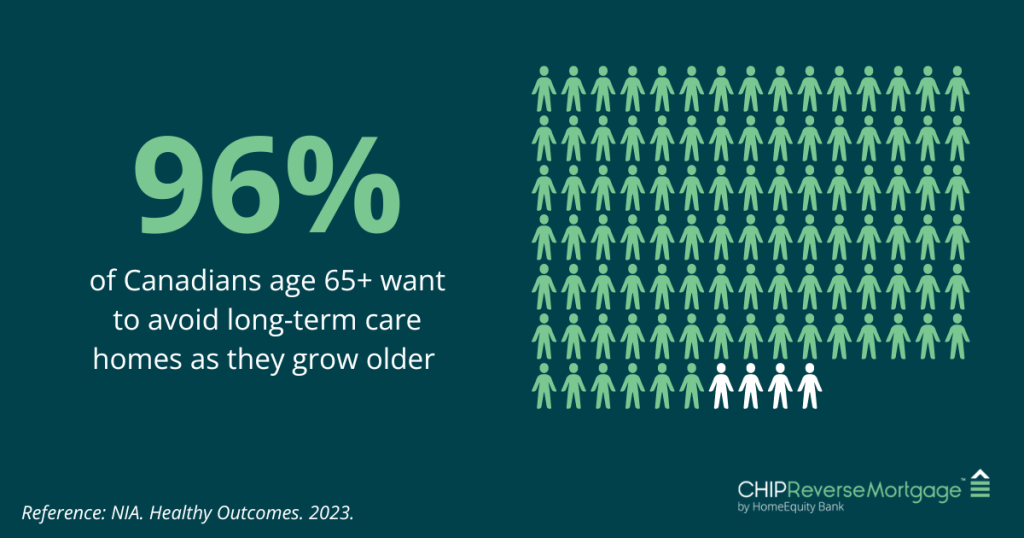

Avoiding Long-Term Care Homes

In a recent report, Healthy Outcomes, the NIA noted “aging in the right place” means “the process of enabling healthy ageing in the most appropriate setting based on an older person’s personal preferences, circumstances and care needs”. Notably, for most Canadians, aging in the right place mean ageing at home, rather than in a long-term care home.

Financial Security and Health

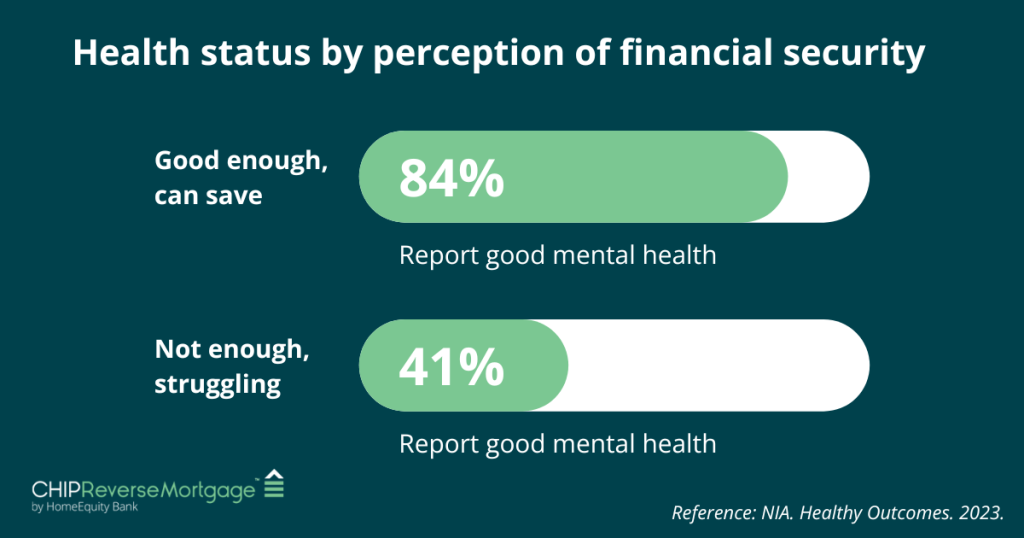

Because Canadians overwhelming see their home as the right place to age, the focus naturally shifts to whether they have the required financial flexibility and good health. The NIA’s report demonstrates that having greater financial security plays a significant role in both the physical and mental wellbeing of older adults. In fact, the NIA’s research revealed that mental wellbeing can be influenced simply by the perception of financial security!

Accessing your Home’s Equity

What does this mean for you? Amongst a number of recommendations, the NIA outlined the need for options that allow Canadians to turn their assets into secure sources of income. For many Canadians, their most important asset is their primary residence, or home. Retired Canadians can access their home equity through valuable financial tools, such as a reverse mortgage, to generate income savings and enjoy a more comfortable retirement.

The NIA report once again proves that financial wellbeing is the cornerstone of a healthy and happy retirement that can be enjoyed in the comfort of their home. That’s why it’s important for Canadians to research all the financial options available to them. The use of home equity, for example, is still an underutilized tool in retirement planning. By making informed choices, Canadians can navigate the path of aging in the right place with confidence, security, and enhanced quality of life.

If you’d like to find out how a reverse mortgage can help you age in the right place, request a free guide!