Let’s set the record straight on the CHIP Reverse Mortgage – this product isn’t for everyone, but it might be the right product for you.

When I announced that I was joining HomeEquity Bank as their Chief Financial Commentator, I was filled with excitement and pride to be sharing the news, but I have to admit, I was a little nervous about the potential push back from my network. Let me tell you why.

In September 2019, Yvonne Ziomecki, HomeEquity Bank’s Executive Vice-President, asked me to meet her for coffee to share her vision and passion for The CHIP Reverse Mortgage. I went into the meeting with some hesitancy and reservations, not thinking for a minute this product was a viable option to supplement retired income.

I share my previous uncertainty because I know many who feel this way. There remains a little skepticism around this product, with some even tagging it as a ‘rip-off’. But before you write this product off, like I nearly did in 2019, I think it is imperative we explore the common misconceptions and replace them with the facts.

Misconception One: A fear that you will lose ownership of your property

The simple truth- you will not. As long as you maintain your property in good order, pay your taxes and have valid property insurance, there are no concerns. Here is why, a CHIP Reverse Mortgage is a non-recourse loan and has a “No Negative Equity Guarantee”. This simply means at the time of repayment, you or your estate will never owe more than the fair market value of your home.

Misconception Two: The costs are too high

Yes, there are mortgage interest costs, and those costs are higher than a conventional mortgage. The reason is, you don’t have to make regular payments like a mortgage. That isn’t how a reverse mortgage works. In fact, not having to make regular payments is one of the biggest benefits of this product but there is a cost with that benefit. A reverse mortgage isn’t like a conventional mortgage offered by other banks because you don’t have to make periodic payments. Instead, the loan is paid off by you if you move or by your estate. This product is designed for those Canadians over 55 who want access to additional funds while retaining the ownership and title of their home. This product frees up some cash to give you a little financial wiggle room. Something to keep in mind: while you don’t have to make regular payments with a reverse mortgage, you can if you want. There are many options to suit your circumstance.

Misconception Three: The process to get approved is overwhelming

At first glance it might appear to be daunting, but let’s break it down:

- Your application will need to include the following information:

- Two separate forms of legal identification

- Proof the property is your principal address

- Your taxes are up to date

- Insurance Verification

- Current appraisal and statement on an existing mortgage

- You will need to obtain independent legal counsel. This is for your own protection to ensure you have a solid understanding of the product, the benefits, risks, and costs. It is a safeguard put into place to help you make an informed decision.

If all of this still feels overwhelming, I completely understand. The good news, there are Client Consultants to help walk you through every step of the way.

Misconception Four: The right customer for this product is struggling financially

People who often tap into the equity of their home can be asset rich and cash poor. However, they may not be. They may simply want to access some of the equity built up in their home. Others may need a little help financially for various reasons but are far from down and out. They may have been savvy enough to buy their home, want to stay there and this product might allow them to do that.

Wondering how much you can borrow? That will be based on several factors including your age, and the age of everyone on title of your home or living in the house, the city where you live, your home’s condition, the type of home, and the appraised value.

To give you a profile of the typical client, according to HomeEquity Bank, their average age is 72 years old and the average amount of a reverse mortgage size is $170,000.

Misconception Five: If I live too long, I will run out of money

One of my greatest fears around this product was – what if I live too darn long and have to sell and move into some form of assisted living? My healthcare costs could escalate and I don’t want to be a financial burden on my family. Will there be enough equity in my home to cover all my costs when I can no longer provide for myself in my home?

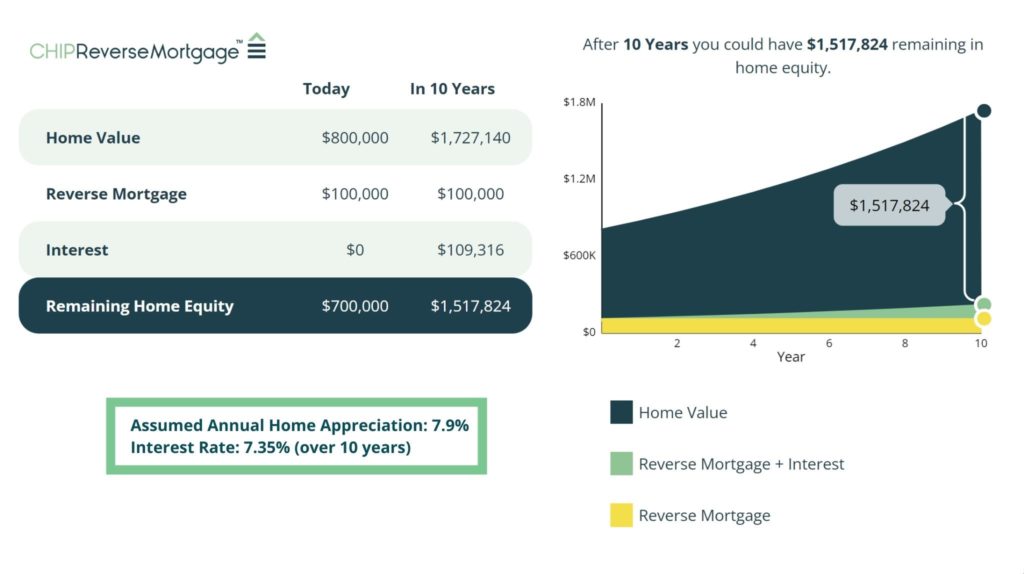

To answer these questions, these are the charts Yvonne provided to me that changed my perception of the product and addressed my concerns. I had completely understated the historical performance of the real estate market. That was the game changer for me.

Finally, I get it, this still might not be the right product for you. However, maybe, just maybe, it is and all I hope is that you make informed decisions. My job isn’t to sell you on it but to explore options to fund your whole retirement.

Your “golden years” are right now. You deserve to enjoy your life to the fullest and that sometimes requires a little more financial flexibility.