Last week, I joined Vivianne Gauci, HomeEquity Bank’s Senior Vice President and Chief Marketing Officer, on Instagram Live to speak about the Bank’s latest research into “Women and Financial Wellbeing,” which considered the willingness of women to talk about their finances.

Conventional wisdom tells us that older Canadian women are reluctant to talk about their finances because it’s “not polite.” For many retired Canadians, this belief still holds true.

However, HomeEquity Bank is working to smash this stigma and empower Canadian women 55+ to take charge of their financial future by encouraging them to ask the right questions and considering all the financial solutions available to them.

Let’s dive into our conversation:

Financial Wellness for Women: Disrupting Stereotypes

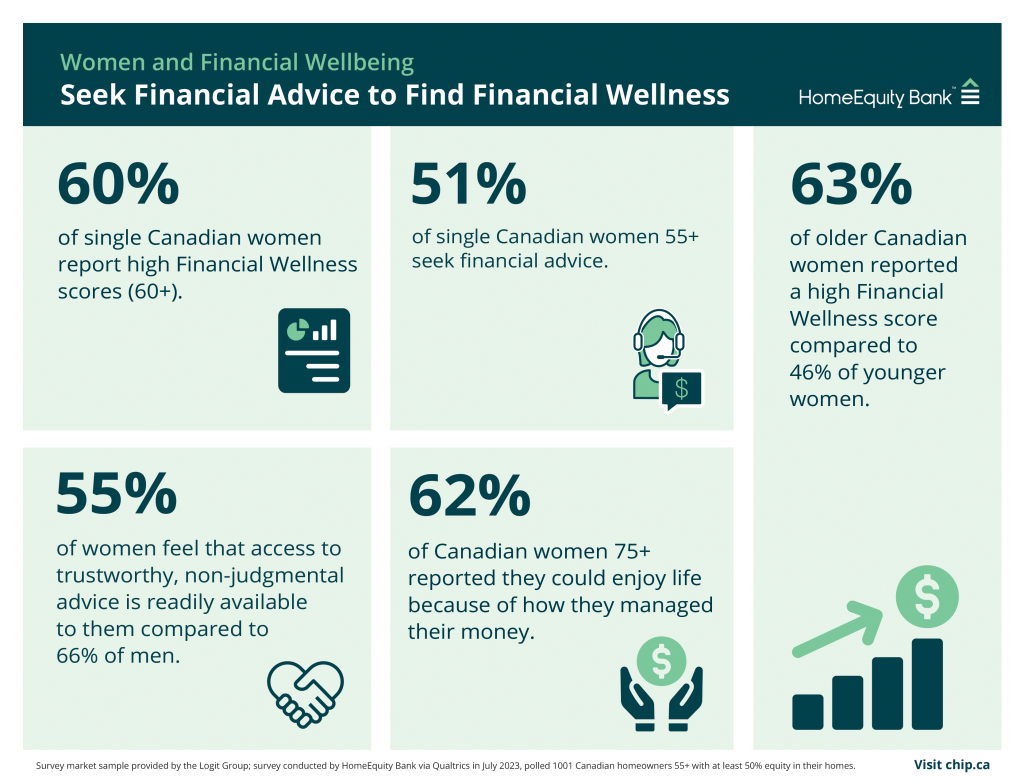

While older Canadian women are often stereotyped as financially “vulnerable,” HomeEquity Bank’s research found that women reported improved financial wellness scores as they aged: 63% of older Canadian women reported a financial wellness score of 60+, compared to only 46% of younger women.

It’s possible that older women have simply had more time to accumulate assets, financial savvy, and general wisdom. Another reason? The research revealed women 65+ are more likely to seek professional financial advice than women younger than 55.

Vivianne and I also spoke about the importance of Canadians, especially women, taking control of their financial wellbeing.

Take Control of Your Finances

Why? We’re living longer, more active lives than ever before. When many Canadians retire at the age of 65, they can expect to live up to two decades in retirement. According to Statistics Cananda, this is even more so for women, who, on average, live approximately four years longer than men.

Additionally, HomeEquity Bank’s survey showed that women solely responsible for their finances scored higher than those who shared the responsibility with family.

I said it then, and I’ll say it again. Nobody will ever care more about your financial future than you. Taking control of your finances now will help secure your future and help you live a better retirement.

Choosing the Right Advisor for Financial Wellbeing

How can women 55+ take charge of their finances? Many prefer to start by doing their own research. If you fall into that camp, HomeEquity Bank’s new Financial Wellbeing tool is designed to help you get a measure of your financial wellbeing and provide you access to customized resources.

That said, one of the best steps you can take to take control of your financial wellbeing is to speak with an advisor. Single Canadian women 55+ seek financial advice more actively than those living with family (they also report higher financial wellness scores).

But women don’t seek professional financial advice as often as men. According to HomeEquity Bank’s research, it may, in part, be that women feel that access to trustworthy, nonjudgmental advice is not readily available.

If you’ve found yourself in this scenario, don’t worry. Here’s some tips for finding the right advisor:

- Proactive communication (especially in uncertain times)

- Communicate both your financial and personal goals

- Provides educational resources and support

- Provides confidence that they are working in your best interest

Remember: Money is mobile, sensitive, and scarce. It can move from advisor to advisor easily and quickly. Take control of your financial wellbeing, and be sure to find the right advisor, and the right financial option, for you.

Pattie – PLR@heb.ca