This is the second article in a series about second mortgages. The goal of this piece is to provide more details including, what the process is to get a second mortgage in Canada, how much an individual can qualify for and what interest rates are charged, who can benefit with a second mortgage the most, and if it is a viable option for Canadian retirees compared to a reverse mortgage. Don’t forget to read our first article if you would like to learn more about what a second mortgage is and what are the pros and cons.

What are second mortgages?

A second mortgage is an additional loan taken out on a property that already has an existing mortgage. With a second mortgage, the borrower must continue to make payments on the primary mortgage in addition to now also having to make payments on a second mortgage. It is called a second mortgage because the primary mortgage takes precedence in the event of a foreclosure.

How to qualify for a second mortgage?

Second mortgages are considered risky for lenders and therefore lenders will ask for the following to approve a second mortgage:

1. Income verification

Lenders will ask to see several paystubs or a copy of your last 2 bank statements in order to ensure that an applicant can afford payments. The more dependable the source of income, the higher the chance that the applicant can qualify for a second mortgage.

2. Credit score

Lenders will ask a credit reporting agency for a review of the applicant’s credit history, which can impact the interest rate on the second mortgage.

3. Equity

The lender will ask the applicant for a listing of their equity. The more equity an applicant has, the more likely it is that they will qualify for a second mortgage.

4. Property

The lender will need to make sure that the property is worth the amount that the applicant claims.

How much can you borrow with a second mortgage?

The amount you can borrow with a second mortgage depends on how much equity you have built up in your property (your home’s value less any existing loans on it). Various lenders have different restrictions on the loan-to-value (LTV) ratio they will lend within. Prime lenders in Canada such as Banks, Credit Unions and Mortgage Companies will only allow you to borrow up to 80% of your home’s appraised value.

For example, let’s say your home is worth $500,000 and you have a current mortgage balance of $350,000, you would only be allowed to borrow an additional $50,000 with a second mortgage.

Appraised value of your home: $500,000

Maximum loan allowed: 80%

Loan amount based on appraised value: $400,000

Minus the balance you owe on your mortgage: $350,000

Second mortgage credit limit: $50,000

For the prime lenders mentioned above, the most common form of a second mortgage is a home equity line of credit (HELOC). Those are restricted by the 80% restriction in the example. However, there is also another form of second mortgage which will be arranged by what is known as a “private” lender. A private lender is often the source of a non-HELOC second mortgage and it just refers to getting mortgage funds from a private individual or a group of investors.

This type of second mortgage involves regular repayments of principal and interest. The maximum LTV for a private second mortgage can be greater than 80%, but it will involve higher rates and fees than a HELOC. The maximum amount will vary by private lender and the higher the LTV, the higher the second mortgage rates and fees (more on that later). Let’s look at the same example of a $500,000 home and a mortgage of $350,000.

Appraised value of your home: $500,000

Maximum loan allowed: 90%

Loan amount based on appraised value: $450,000

Minus the balance you owe on your mortgage: $350,000

Second mortgage credit limit: $100,000

Second mortgage rates and fees

Depending on the lender, and the above factors (income, credit score, equity and property), the second mortgage interest rates will vary. In most cases, an applicant will have higher second mortgage rates than their first mortgage because the first mortgage has priority on the collateral if the borrower defaults on the loan.

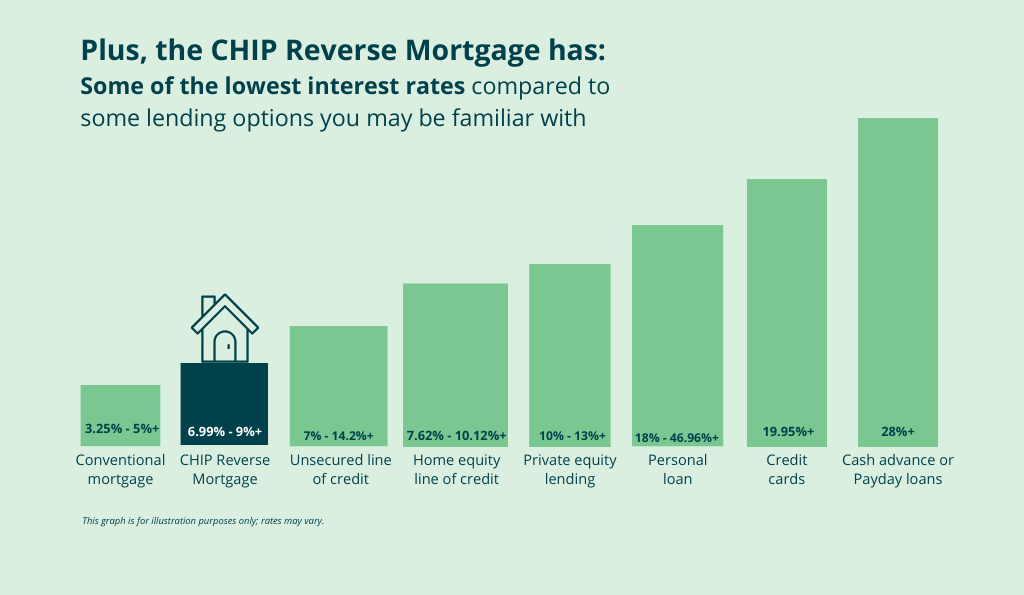

The interest rate on a second mortgage in Canada can be either fixed or variable. Although the interest rate on a second mortgage will be higher than on the first mortgage, the interest rate may be lower than other types of loans, including credit cards and unsecured lines of credit.

The fees for a second mortgage in Canada can also be quite hefty. An applicant may have to pay for appraisal fees, title search fees, title insurance fees and legal fees associated with a second mortgage loan.

Make sure you do your research when you are looking for the best second mortgage and shop around so that you can ensure you are getting the best deal. Be sure to include the following in your search:

- A local bank or credit union

- A mortgage broker

- An online lender

Here is an example of what the second mortgage rates may be for a HELOC, which is only available with a major bank or credit union and means that you will need to have good verified income, a high credit score and high minimum equity. We have also included the second mortgage rates available with a private lender.

Second mortgage terms and conditions

The biggest risk associated with applying for a second mortgage is the possibility of foreclosure. Second mortgage terms dictate that you will not only have to pay the payments of your first mortgage, but will also have to keep on-top of the payments for your second mortgage as well. And because second mortgage rates in Canada are higher than those for first mortgages, your overall monthly payments will increase. If you run into trouble paying back the first or second mortgage, your home is at risk of being foreclosed.

Who can benefit from a second mortgage

Second mortgages are often recommended as a short-term financing solution. The high interest rates along with the large penalties and fees can discourage individuals from taking a second mortgage. In addition, an applicant must have sufficient equity in their home in order to support a second mortgage.

Since income and credit history both play an integral part in the qualification process of a second mortgage, many Canadians 55 plus or Canadians who are approaching retirement may not qualify.

DOWNLOAD OUR FREE RESOURCE

Check out the most important questions answered on Reverse Mortgage

Reverse mortgage: an alternative to a second mortgage

For Canadians who are retired or approaching retirement, a reverse mortgage can be a great alternative solution. The CHIP Reverse Mortgage® in Canada is a loan secured against the value of your home. To be eligible in Canada, the homeowner(s) must be at least 55 years of age and can qualify for up to 55% of the value of their home in tax-free cash. In addition, you can continue to live in your home and maintain full ownership. The best part is, the reverse mortgage will also help consolidate your debt so that you no longer have to make any monthly payments.

Just like a second mortgage, a reverse mortgage does have higher interest rates. But, unlike second mortgages, there are no regular mortgage payments required for as long as the homeowner(s) live in the home. Once the homeowner(s) move, sell or pass away, their reverse mortgage will become due.

A reverse mortgage is a great solution for Canadians 55 plus who are house rich and cash poor. Many retirees have found that they have not saved enough to live the retirement they want and may be struggling to make ends meet, yet they are living in a property that has the potential to help pay them back. A reverse mortgage can help Canadian homeowner(s) live a better retirement on their own terms.

What can you use a reverse mortgage for?

Reverse mortgage customers can choose to use their reverse mortgage funds for anything they please. However, here are some of the most common use of funds:

- Home renovations

- Living expenses

- Pay off debt/debt consolidation

- Income supplement

- Health care or medical expenses

- Gifting a family member/early inheritance

To find out how much tax-free cash you could qualify for with a reverse mortgage, call us toll-free at

1-866-522-2447 or get your free reverse mortgage estimate now