How to get out of credit card debt and restore your financial health

With the new year, if you’re like many Canadians, your credit card debt from the previous year including the holidays may be piling into your statements, month after month. If you hold multiple credit cards, and are only making minimum payments, it will not be long before your debt becomes unmanageable. According to the credit agency, TransUnion, as of Q3 2020, Canada’s average credit card debt is $3663.

So, how do you get out of credit card debt? Can the elderly stop repaying credit card debt? What is the best way to consolidate credit card debt? In reality, it is not so difficult to pay off credit card debt if you follow a systematic plan and a disciplined approach. Here’s what to do to get out of credit card debt:

- Take stock: Start with taking stock of your accumulated debt, followed by rate negotiations with the credit card companies to see if there can be a minor reduction in the interest rates. Even if they agree to a one or two percentage point reduction, it can lead to significant relief on your overall debt.

- Monitor your expenses: This will give you a better sense of your current spending habits. Separate your committed expenses, such as mortgage, utility bills, car or insurance payments, or phone or cable bills, from leisure activities, entertainment, and other such expenses.

- Make a budget: Based on the segregation of any regular committed versus variable expenses, put together a realistic budget for your revised monthly spends. Keep the essentials, and remove some of the unnecessary expenses by making lifestyle adjustments, until you get back on top of your finances.

- Create a payoff strategy and track your progress: The most popular payoff approach is to prioritize your available funds for repayment on the highest-interest credit card, while making minimum payments towards the other cards. This will allow you to pay off your credit card debt in the fastest possible way, with the least interest cost burden. Some choose a reverse payoff strategy by eliminating the debt on the lowest-interest card first. While that is not the most cost-effective approach from an interest accumulation perspective, it provides a psychological boost in your debt payment journey.

- Minimize your temptation to spend. Research suggests that stashing away credit cards and paying in cash for any expense may reduce overall spends. This is because we tend to contemplate more during cash purchases, as compared to those made by swiping a credit card. Identify your personal motivators for adopting a conservative spending approach and staying on track. For example,

- Avoid excessive browsing of online shopping sites.

- Visualize your post-debt payoff scenario, and the things that you can afford thereafter.

- Find a community or forum that allows you to connect with other impacted individuals to share challenges. You can also swap tips and success stories on the best way to pay off credit card debt.

No matter which payoff strategy you choose, restoring your financial health requires a better understanding of:

- Various cards available in the market, especially the ones that can help reduce your interest payments through low balance transfer rates.

- Other options that you can use to get rid of credit card debt.

In this post, we have addressed both these aspects. Read on to know more.

Please note: These numbers are from Early 2021, but rates and offers are usually dynamic, hence, be sure to check with each financial institution before you apply.

Best cards for lowering your interest payments in the next 12 months

When you are looking for easy ways to pay off credit card debt, one of the first options to explore is transfer of outstanding balances to a lower interest card. There are several cards on the market that offer:

- Low introductory rates for short periods of time

- Surprisingly low rates, indefinitely

With so many options out there, how do you know which card is right for you? Typically, the best card for you will depend on how long you think it will take for you to pay off the balance. There isn’t much point in getting a low introductory interest rate if, after six months, you have to pay 21.99% interest on an already large accumulated balance. Although there may be many appealing introductory offers out there, it is important to read all the fine print.

The cards with the lowest promotional rates for the longest periods can save you the most in interest. Some of these cards also offer rewards that can save you even more money.

RBC Rewards+ Visa: Offers an introductory rate for balance transfers of 1.90% for 10 months and then 19.99% after the promotional period. It has no annual fee, but its balance transfer fee is between 1-3%.

BMO Preferred Rate Mastercard: Has an introductory rate of 3.99% for nine months and a low rate of 12.99% after the promotion expires. The $20 annual fee is waived for the first year and it has a 1% transfer fee.

MBNA True Line Gold Mastercard: While this card doesn’t have an introductory rate, it offers a very low rate for balance transfers and purchases of only 8.99%. Its annual fee is $39, and it has a 1% balance transfer.

Tangerine Money-Back Credit Card: Offers an introductory rate for balance transfers of 1.95% for six months and then 19.95% after the promotional period. It has no annual fee but does have a 1% balance transfer fee.

PC Financial Mastercard: Offers a promo rate of 0.97% for six months, then 20.97% thereafter. It has no annual fee but does charge a 1% balance transfer fee.

HSBC+ Rewards Mastercard: Also doesn’t have an introductory offer, but does have a low interest rate of just 11.90% and its annual fee of $25 is waived for the first year. Its balance transfer fee is between 1-5%.

Here is a comparison table, based on the assumption of a $5,000 balance for a full year, including costs of interest, and applicable annual fees and transfer fees. As you can see, when comparing these six cards to an average credit card with 19.99% APR, you could be paying less than a third of your current interest charges.

| Credit card type | Introductory offer and fees | Interest on a $5,000 balance (plus balance transfer and annual fees) within the first 12 months |

|---|---|---|

| Average card at 19.99% APR | $999.50 | |

| RBC Rewards+TM Visa Card | 1.90% for 10 months19.99% thereafter

No annual fee 1‑3% balance transfer fee |

$295.75 (up to $395.75 with 3% balance transfer) |

| Tangerine Money-Back Credit Card | 1.95% for 6 months19.95% thereafter

No annual fee 1% balance transfer fee 8.99% thereafter Balance transfer fee applicable |

$597.50 |

| PC Financial Mastercard | 0.97% for 6 months20.97% thereafter

No annual fee 1% balance transfer fee |

$598.50 |

| HSBC +Rewards Mastercard | 11.90% on balance transfers and purchases$25 annual fee waived for first year

1-5% balance transfer fee |

$645.00 (up to $845.00 with 5% balance transfer) |

Best cards for extended pay offs

At times, the magnitude of your credit card debt, along with the availability of cash flow may lead to a situation where you need several years to pay off what you owe. In such instances, choose the credit card with the lowest long-term interest rate.

If you think you will carry a balance for two years or longer, you could pay the least interest/fees with the MBNA True Line Gold Mastercard. With a regular credit card with a 19.99% interest rate, you would pay $1,999 in interest over two years if you keep a $5,000 balance. Carrying the same balance over the same period, with the MBNA True Line Gold Mastercard you would pay only $1,027.00 in interest and fees.

If you kept a balance of $5,000 over five years, with a regular 19.99% credit card, you would pay a total of $4,997.50 in interest. With the same balance over the same period, with the MBNA True Line Gold Mastercard you would pay only $2,492.50 in interest and fees. This would save you $2,505 over five years.

Other ways to get out of credit card debt

Balance transfers is not the only way to pay off your credit card debt. A debt consolidation approach could reduce and simplify your monthly payments, helping you get rid of debt quickly and efficiently. Depending on your age, current financial situation, income sources, ability to pay, credit scores, size of accumulated debt, and expected timeline to get out of credit card debt, here are some options to consider:

- Approach a non-profit counselling organization: Get an expert review your entire financial situation, along with sound budgeting advice and an effective debt management plan. Credit counselling agencies work with your creditors to try and negotiate lower interest rates or get certain fee waivers, while also setting up a repayment plan on your behalf. Essentially, you make a single monthly payment to the agency, which they use to pay your creditors. Some of the downsides of this arrangement are:

- You may have to pay a service fee to the credit counsellor.

- You may have to sign an agreement that you will not apply for new credit, or use existing credit, during the tenure of the debt payment plan.

- Apply for a personal loan: If you have a reasonable credit score, you may qualify for a flexible term, low-interest rate, personal loan that charges less interest than your existing credit cards. Pay off all your credit card balances and continue making a single monthly payment towards the personal loan. However, if you have had financial difficulties in the past, chances are that your credit score may have also been impacted. Which means, you may not meet the lender’s eligibility requirements for a personal loan, or the interest rate they offer may be similar to the rate charged by your credit card companies. Besides, you may also have to pay an origination fee that eats into your loan funds, even before you receive them.

- Use your retirement account loan: If you participate in an employer-sponsored retirement account that allows a loan option, you may be able to utilize a portion of this fund to pay off your credit cards. Such withdrawals do not need a credit check. In fact, you enjoy relatively low interest rates, as compared to what you would pay a bank or other lenders for a personal loan. However, if you are unable to repay this loan, the amount you withdrew could be taxed. You may also incur huge penalties on top of that. Since the borrowed amount will not earn interest, any withdrawal from your retirement account will impact the potential growth of your overall retirement income.

- Seek help from family or friends: While this may not be your preferred option, some people consider borrowing money from a friend or family member, if that is a possibility. However, it is important to ensure that you conduct this dealing in a professional manner, just the way you would deal with a bank or a lending institution. Clearly outline and document the loan terms, repayment options, tenure, and interest, as agreed between you and your lender. While you may be able to get a low-interest loan despite a poor credit score, borrowing within your social circle could lead to a tricky situation. If you slip up on the repayment terms, not only will it put a strain on your relationship, but it may also put your family member’s or friend’s finances at risk.

- Consider a home equity loan or reverse mortgage: Elderly Canadians who are still paying credit card debt have the option to cash in on their home’s equity in the form of a HELOC, second mortgage, or reverse mortgage. While other home equity loans may require minimum credit scores or proof of income to meet financial commitments, a reverse mortgage may be the ideal solution for Canadians 55+ with credit card debt.

- If you are over 55 years of age, you can get tax-free cash up to 55% of the value of your home, in the form of a reverse mortgage

- Continue to stay in your home and retain its full ownership

- Choose from lump sum payout or multiple disbursals over an extended period of time

- No monthly mortgage payment burden. A reverse mortgage is repayable only when you decide to move out of your home, sell your home, or pass on.

Use the CHIP Reverse Mortgage® to consolidate credit card debt

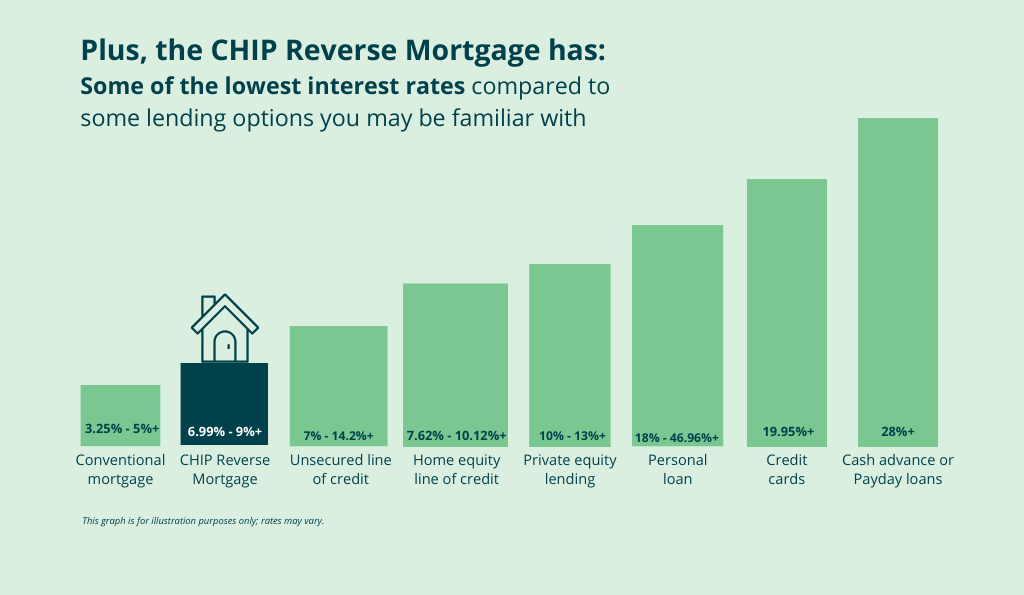

Among all the debt consolidation options, the CHIP Reverse Mortgage from HomeEquity Bank may be one of the best ways to pay off credit card debt. A powerful and flexible tool, it offers interest rates that are considerably lower than even the best credit card rates in Canada. While you can choose to make interest payments, you don’t have to! Hence, the CHIP Reverse Mortgage could be of great help for Canadians 55+ with credit card debt. It can reduce your monthly debt payments to zero, while also helping you secure your retirement finances for a number of other purposes.

Eager to get out of credit card debt? Call 1-866-522-2447 to learn how the CHIP Reverse Mortgage can give you access to tax-free cash, without the burden of monthly repayments.