How to fund your retirement years?

This is the first part of a series that explores the subject of retired Canadians and their finances. For example, what is the difference between a mortgage refinance and a second mortgage? Is a home equity loan considered a second mortgage? We will try to answer important questions about accessing home equity loans for retirement income.

Most aging Canadians want to enjoy the comfort of staying in their own homes, but the rising cost of living and ever-increasing home maintenance expenses make it harder for them to do so. A 2018 national survey by Sun Life Financial found that a quarter of Canadian retirees are in debt. Benefits Canada quotes surveys by RBC Insurance and TD Bank showing that many Canadians are worried about not having sufficient funds post retirement.

Let us examine 3 reasons why Canadians are outliving their retirement savings.

- A longer lifespan: For years, Canadians have been underestimating the amount they would need to save for retirement. Increasing life expectancy has a lot to do with this. Health care advancements have been a major contributor as to why, in Canada, for the first time, the number of Canadians aged 65 and older exceed the number of children aged 0 to 14.

- Increasing cost of living: Keeping up with inflation is a continual challenge. Many Canadians find that they are unable to keep up with basic home and living expenses despite working well past their retirement age.

- Lack of proper financial planning: According to a CIBC survey outlined in a Financial Post news report, Canadians believe they need approximately $756,000 in retirement savings. However, 90% do not have a proper plan to acquire this amount and 53% are not sure they are saving enough. The uncertain stock markets add to their concerns. There is also the added risk of a health or family crisis wiping out everything they have saved.

Is tapping into home equity the solution?

Home equity is slowly becoming a dependable source of income during retirement years. In fact, some Canadian retirees even incorporate home equity loans into their retirement planning, to enable them to live a financially independent lifestyle. However, regardless of rising home prices in Canada, many older Canadians still do not automatically think of drawing from their home equity during tough financial times. A lack of knowledge about home equity products and how to use them may prevent Canadians from enjoying their benefits. Understanding if a home equity loan is considered a second mortgage and the difference between a refinance and second mortgage, for instance, can help you make informed financial decisions about your borrowing options.

Canadian home equity loans – what are they?

Home equity loans are tools that allow you to borrow money by using your property as collateral. The loan amount is typically determined by the amount of equity you have accumulated in your home. To better understand how this works, here’s what you need to know about home equity.

Home equity is one of your most valuable assets, which you can potentially access during your retirement years. You may often hear people saying that home ownership builds your wealth and net worth. What they are referring to is simply the equity that you have accumulated over time. The amount of equity you have is determined by subtracting any unpaid mortgage debts or liens from the current value of your home.

Not sure what this means? Here’s an example to explain better. Let’s say your home is valued at $500,000 and your mortgage balance is $300,000. This means you have $200,000 in home equity. Over time, as the value of your home increases and you continue to repay your mortgage, your home equity will also increase.

The loans we are referring to allow you to borrow money against this equity. Interest rates on these can also be much lower than other borrowing tools such as credit cards.

Common questions about home equity loans

Is a home equity loan also considered a type of second mortgage? A second mortgage is actually a loan that uses some of your home’s equity. So, it is a type of home equity loan but different from a home equity line of credit.

What’s the difference between refinance and second mortgage? Simply put, a refinance loan converts your existing mortgage into a separate, larger one. However, a second mortgage can be a loan of a smaller amount that you take for home improvements or to pay off some debt. We will elaborate on this in the next section covering the different forms of home equity loans.

Types of home equity loans

When it comes to home equity loans, you have three main options. Comparing the key features of each loan type will help you decide what is most suitable for your financial situation.

- Home equity line of credit (HELOC): A home equity line of credit (HELOC) can give you access to a large amount of cash. Federally regulated lenders can offer you 65% to 80% of your home’s appraised value minus the unpaid mortgage amount. You can use it for any purpose, as there are no fixed guidelines or utilization conditions. Your monthly HELOC calculations are based on the amount borrowed and the current interest rate.

Eligibility

The terms and qualifications vary by lender; so, be sure to read the fine print carefully, before you sign on the dotted line. Typically, you will need:

- A minimum down payment or equity of 20%

- A minimum down payment or equity of 35% (if you want to use HELOC on a stand-alone basis in place of a mortgage)

- A minimum, pre-defined credit score

- Proof of stable and sufficient income

- An acceptable debt-to-income ratio

- To do a “stress test” to prove that you can afford payments at a qualifying interest rate that is typically higher than the actual rate in your contract.

So, is a home equity loan considered a second mortgage? In the case of a HELOC, it depends. Typically, most borrowers get a HELOC in addition to an existing mortgage, which makes the HELOC a “second mortgage” by definition. However, it is different than the usual way one thinks about a second mortgage, which is usually thought of as a fixed loan with regular principal and interest payments. We explain second mortgages in detail below.

- Second mortgages: A second mortgage is an additional loan taken out on your home with a different mortgage lender. It gives you access to the equity in your property by using your home as collateral. As a mortgage holder, you will have to continue making payments on both, the primary and the secondary mortgage.As a homeowner, if you choose refinancing, you continue to have one mortgage and a single payment to the same lender. In the case of a second mortgage, you as a borrower will have two mortgages. You will be required to make two separate payments to two different lenders.The amortization period for refinance can be as long as 25 or 30 years, so you have sufficient time to pay off your mortgage. On the other hand, you have less time with a second mortgage which is usually required to be paid within a year. You may be offered a choice to renew the second mortgage, but the lender will charge a fee for renewal.Interest rates for second mortgages are higher because the risk to the lender is potentially greater. For cash-out refinancing, you may be able to borrow at a much lower rate with a good credit history and if the amount you want to borrow is within the institutional limit at the time. Currently this is at 80%.

Eligibility

In order to qualify for a second mortgage, lenders look at a borrower’s equity, income, credit score and property value.

- The more equity you have available, the higher your chances of qualifying

- Lenders will want to verify that you have a dependable source of income

- The higher your credit score, the lower your interest rate

- Lenders will appraise your property, to know the valuation if you fail to make timely payments

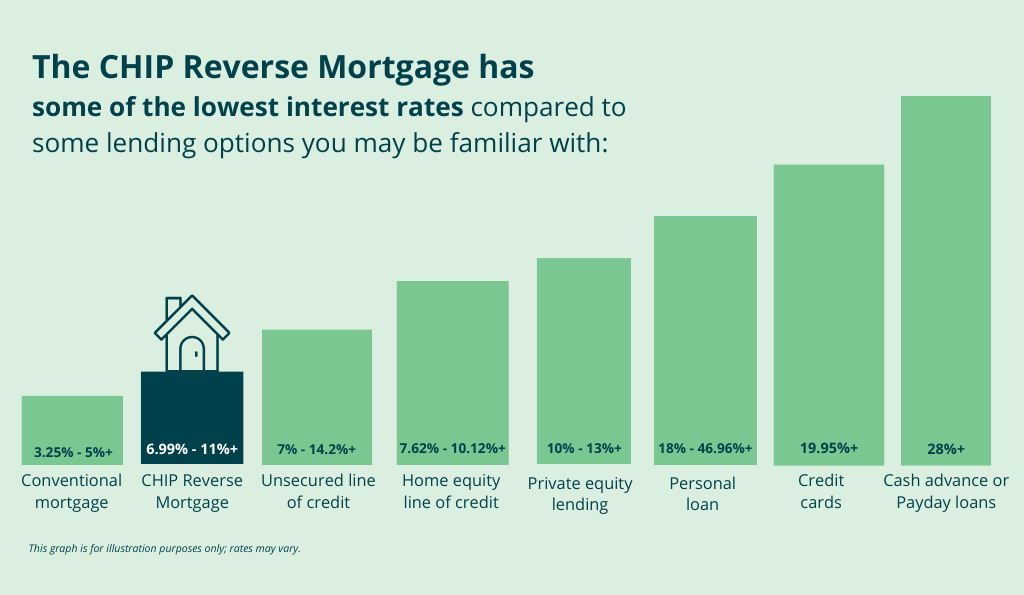

- Reverse mortgage: A reverse mortgage allows homeowners to borrow against their home’s equity while maintaining ownership and continuing to live in their home. This is a valuable financial planning tool that can help increase your retirement income by using one of your largest assets. A borrower can get up to 55% of the appraised value of their home in tax-free cash, but your actual amount is based on a few factors including your age (and the age of your spouse, if applicable), the value of your home, and the location and type of your home. Reverse mortgages require no monthly mortgage payments until the borrower moves, sells or no longer lives in the home. The interest rates are slightly higher than a conventional mortgage, but significantly lower than second mortgages and there are no monthly payments to make.

Eligibility

In order to qualify, you must be 55 years of age or older and own a home. When you apply for a reverse mortgage, your lender will consider:

- Your age and the age of your spouse

- The location of your home

- The value and type of home you have (i.e. condo, semi-detached or fully detached)

You will need to pay off any outstanding loans that are secured by your home, such as a mortgage or home equity line of credit. However, you could use the money you get from a reverse mortgage to do this.

In general, the older you are and the more your home is worth when you apply for a reverse mortgage, the more money you could get for your retirement years. Current market trends will also impact your eligibility amount.

DOWNLOAD OUR FREE RESOURCE

What suits your needs? Reverse mortgage or HELOC

Reverse mortgage vs. other home equity loans

Each of the home equity loans outlined above can be an option worth considering, depending on your profile, repayment capacity, and current financial situation. We are often asked about the benefits and differences between a reverse mortgage, refinance and a home equity loan. A reverse mortgage is a product made specifically for Canadians 55+, to help relieve their financial concerns during their retirement years. One of its greatest advantages is that you do not have to make any regular payments. Let us go over some key differences between home equity loans and reverse mortgages.

The bottom line

Both a reverse mortgage and a home equity loan will allow you to convert a portion of your home’s equity into cash. The option you select will depend on your lifestyle, financial goals, credit standing, and your cash flow needs.

If you have further questions about the differences between refinance, reverse mortgage, second mortgage or home equity loan, we are here to help. Call us at 1-866-522-2447 now!

If you’re interested in finding out how much tax free cash you could qualify for with a CHIP Reverse Mortgage®, try our reverse mortgage calculator.