It’s no secret that many Canadians are nearing retirement with little in the bank. According to a CIBC poll, almost a third of Canadians approaching retirement have no savings at all.

A Sun Life Financial survey also revealed that a quarter of retired Canadians are in debt, with one in five of them still paying off a conventional mortgage. A combination of low (or no) retirement savings, higher living costs and longer life expectancy has meant that many Canadians are looking to help finance their retirement with their home’s equity.

And, as Canadian home ownership statistics show, almost 68% of Canadians own their own home. Many of these homeowners, then, consider home ownership alternatives, such as renting versus home ownership.

Giving up home ownership to fund retirement

Many cash-poor, house-rich Canadian retirees are cashing in on their home’s equity to help pay for their retirement. If they do decide to sell their home, they typically go with one of these home ownership alternatives:

Downsizing: A very common financial move is to sell their home and buy a smaller place, often in a cheaper town or neighbourhood.

- Benefits: You get to cash in a part of your home’s equity and still have home ownership.

- Disadvantages: The costs of downsizing are in the tens of thousands of dollars; most home ownership schemes are aimed at first-time buyers, so they don’t apply to downsizers. To find a much cheaper home, you often have to move far away from friends and relatives and leave behind many memories you have made in your family home over the years. You can find out more about the costs of downsizing here.

Renting: Another option is to sell your home in order to cash in all of the equity and then rent for the remainder of your retirement.

- Benefits: You typically receive a large lump of cash from the home sale that can help boost your retirement finances. You no longer need to worry about the maintenance costs, utilities, city taxes, or other expenses that come with home ownership.

- Disadvantages: When it comes to rent versus home ownership, the downsides of renting are that you have to pay rent for the rest of your life, you don’t get to benefit from your home appreciating in value and you could be forced to leave at any time by your landlord. Overall, the average rent and its indirect expenses are considerably higher than the average cost of home ownership, when your conventional mortgage is paid off.

Moving to a retirement home: Many Canadian retirees use the money from the sale of their home to move to a retirement community.

- Benefits: For some people, the average cost of home ownership (especially if you are still paying a conventional mortgage), along with the physical demands of home ownership in Canada, make living in a retirement home an attractive alternative. You pay monthly rent and it often covers everything: meals, cleaning, utilities, as well as recreational activities. Your health needs are taken care of and you have a ready-made social life.

- Disadvantages: Retirement homes can be costly: depending on the home’s location and your needs and preferences, they can cost anywhere between $2,000-$10,000 per month. You lose your independence, up to a point, as well as the home you have lived in for many years. Compared to the average cost of home ownership in Canada, if your conventional mortgage is paid off, retirement home rent can be very high and quickly eat into your savings – not to mention with a retirement home, you lose out on a lot of your personal space. Meals are often in communal areas, and the rooms are likely much smaller than the space you were used to in your home.

How a reverse mortgage can help you maintain home ownership

A reverse mortgage allows you to avoid having to consider home ownership alternatives by cashing in up to 55% of your home’s equity. The money can be used for any reason: for example, to help pay for repairs and the upkeep of your home, as well as other expenses of home ownership; to pay off outstanding debts; and to boost your retirement income.

Canadian home ownership statistics reveal that the number of Canadians aged 55+ with a conventional mortgage is growing, so retirees are increasingly using a reverse mortgage to pay off their conventional mortgage. With no regular mortgage payments to make, this frees up a lot of your income, so you can enjoy a more care-free retirement. The money you owe is only due when you decide to sell your home or pass away.

The benefits of home ownership in Canada

By using a reverse mortgage, you’ll continue to enjoy the advantages of owning your own home:

- Benefit from any appreciation in the value of your home, when you decide to sell it

- You are your own landlord and have the security of knowing you can live there as long as you like

- The average cost of home ownership, when your conventional mortgage is paid off, is far less than renting or retirement home options

- Continue to live near friends and family

- Enjoy living in a familiar neighbourhood that has all of your favourite amenities

- You get to live among the memories of your home, made over many years

How the CHIP Reverse Mortgage® helps protect your home’s equity

While many people understand the advantages of home ownership in Canada, some people are reluctant to take on a reverse mortgage because of a common misconception: they believe that you will end up owing more than the property is worth. Not only is this incorrect, but HomeEquity Bank has also taken a number of measures to help protect your home’s equity.

1. Retain ownership of your home

Just like with any other mortgage, you remain on title, you do not transfer ownership to HomeEquity Bank. In fact, once it’s time to pay back the reverse mortgage, you or your heirs have a choice when it comes time to settle the loan.

2. Our conservative lending

At HomeEquity Bank we lend up to 55% of the value of the home, depending on the age of the homeowner(s), property type and location of the home. Homeowners 55+ are eligible for the product and the older you are, the more cash you will qualify for. The reason for this is we want to ensure that your reverse mortgage will never exceed the value of your home. Therefore, we lend less to someone who is 55 than to someone in their late 80s.

3. Your home will likely appreciate in value

You get to enjoy the appreciation on the total value of your home, whereas interest only accumulates on the amount that you borrowed. This is why over 99% of homeowners have money left over when their loan is repaid.

An example of home equity preservation

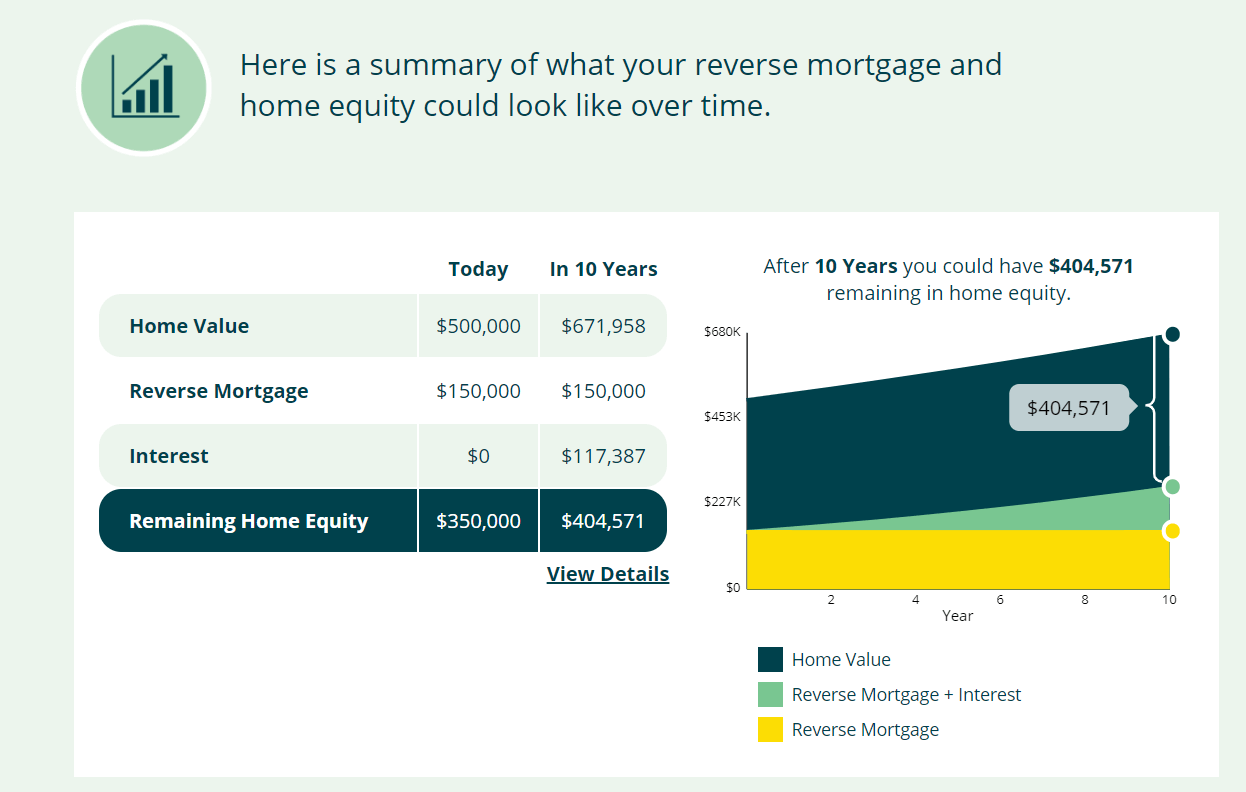

In the illustration below, a combination of conservative lending practices and a modest level of home appreciation of just 3%, would mean a considerable increase in home equity after you get the CHIP Reverse Mortgage.

In this example, a customer has a home with an appraised value of $500,000. They qualify for a reverse mortgage of $150,000 or 30% of the value of their home. The homeowner takes out the CHIP mortgage for 10 years, before selling it. When the loan is paid back, because there is a 3% home appreciation on the property, the home value is now $671,958.

The principal plus interest add up to $267,387 and the estate is still left with $404,571 in home equity at the time of sale. The home has seen an increase in equity of $54,571 since the loan was taken out, a considerable benefit that you don’t get from home ownership alternatives

Home Equity Preservation Graph – CHIP Reverse Mortgage

The following graph is for Illustration purposes only

This above illustration uses conservative values:

The above graph uses a very conservative home appreciation estimate of only 3% per year. According to the Canadian Real Estate Association, over the last 14 years, the average price for a home in Canada has increased by around 108%, considerably more than 3% annually. HomeEquity Bank makes no representations on future housing market performance. It is also based on an interest rate of 6.99% for a five-year term mortgage.

The HomeEquity Bank negative equity guarantee

Many people assume that if your home equity depreciates in value at the time before it is sold, you or your heirs will end up owing more than the house is worth.

However, this is not true; owner’s negative equity is never an issue for HomeEquity Bank’s customers. Due to our No Negative Equity Guarantee, as long as the client meets their mortgage obligations, HomeEquity Bank guarantees[1] that the amount they will have to pay on their due date will not exceed the fair market value of their home.

If their home depreciates in value and the mortgage amount due is more than the gross proceeds from the sale of the property, HomeEquity Bank covers the difference between the sale price and the loan amount. This ensures that owner’s negative equity is not a concern.

Some facts about the CHIP reverse mortgage

- You retain ownership of your home for as long as you live in it. Your heirs can take possession of the home after paying off the reverse mortgage or sell the home to pay off the debt

- You will never owe more than your home’s value when it is sold due to the no negative equity guarantee

- You can choose to pay the interest on your reverse mortgage, but it is optional (there are no required monthly interest or principle payments)

- You can use a reverse mortgage to pay off your current, conventional mortgage – and because you don’t have to make any regular mortgage payments, this can greatly reduce the average cost of home ownership

How to keep the benefits of home ownership with a reverse mortgage

If you’ve been considering using some of your home’s equity to help fund your retirement, but don’t want to move out of your home, a reverse mortgage could be the ideal solution. It allows you to continue to enjoy the benefits of home ownership in Canada while having access to the funds you need. For many people it offers a better option than home ownership alternatives.

To find out how much you could qualify for and what the impact may be of the reverse mortgage on your home equity over time, try our home equity calculator, or call us at 1-866-522-2447.

[1] The guarantee excludes administrative expenses and interest that has accumulated after the due date.