Home Equity – A Big Advantage for Canadian Seniors

As the value of a property grows, the equity increases as well and can be an excellent source of income. Canadians homeowners age 55 or older can take advantage of HomeEquity Bank’s CHIP Reverse Mortgage to access up to 55% of the equity in their home.

What does Home Equity mean?

Home equity is the real value of your property. In other words, it’s the difference between the market value of the home and the remaining balance that is owed on a conventional mortgage. For example, if your home is worth $200,000 in the market, and you owe $50,000 on your mortgage, your equity is $150,000.

The opportunity to utilize the increase in the value of your property is one of the biggest advantages of owning a home. Although the equity in your home cannot be sold, it can be used as security for a reverse mortgage. Senior homeowners in Canada can benefit from the equity in their home by getting safe and secure access through the CHIP Reverse Mortgage. The exact amount available will depend on the age of the homeowner and his/her spouse, the type of home, its location and its current market value, and any secured debts.

Put your home equity to work with a reverse mortgage

With a reverse mortgage, you can choose to take a lump sum of money or to receive funds over time. As long as the property is well maintained, and property taxes and property insurance is paid, the homeowners will continue to own their home and HomeEquity Bank will never take possession.

No regular payments are required; the loan does not become due until the home is sold or both homeowners move out. Interest is added on to the original amount borrowed. When the amount is repaid, all remaining equity in the home belongs to the homeowners (or their estate).

Check now for current CHIP Reverse Mortgage rates offered by HomeEquity Bank.

An answer to your post retirement financial needs.

The equity in your home can be accessed safely and securely for necessities such as:

- Paying off debts

- To fund a college education for your children or grandchildren

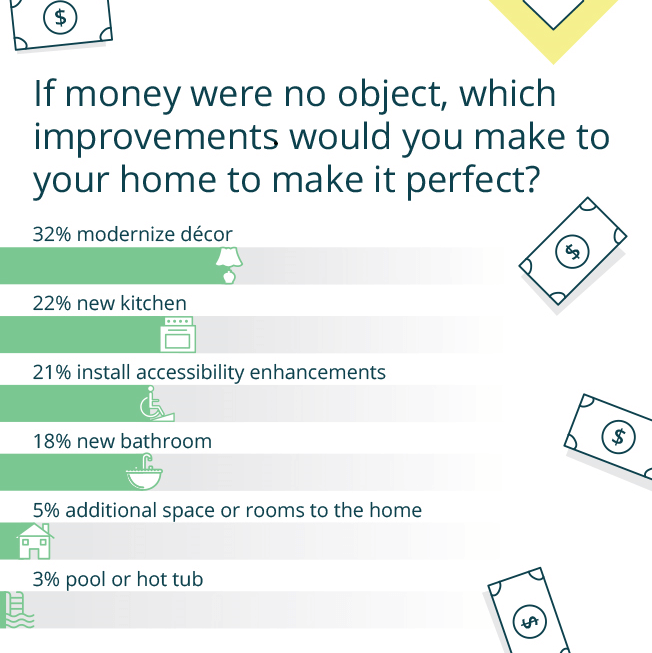

- Make home improvements that will increase the value of your property, or make it more accessible and comfortable

-

- Cover unexpected medical bills or other expenses.

- Pay for a hobby or travel.

Whatever your needs, whether you need extra money for a vacation or just want to maintain your current lifestyle, money from a reverse mortgage can be used however you want.

If you are a Canadian homeowner, 55 years or older, learn more about how you can make your reverse mortgage work for you.