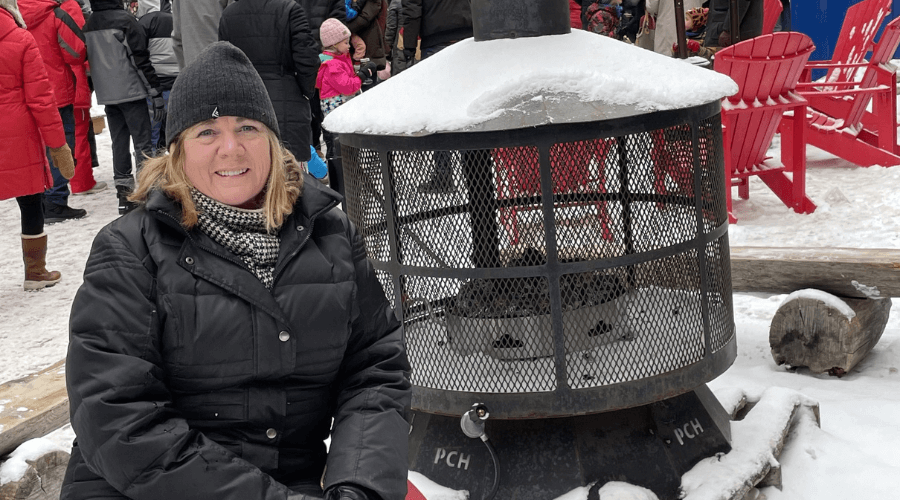

I can’t imagine anything could get in Susan William’s way. She’s the creator and publisher of Booming Encore, a site for those born between 1946 and 1964. Williams launched Booming Encore almost ten years ago. According to Williams, directly after retiring, for most, there is a six-month honeymoon stage —until the newly retired begin searching for what they want to do for the rest of their lives. That’s where her site becomes a gold mine of balanced and researched information for fresh ideas about aging. According to Williams, the pandemic brought the idea of aging with purpose into focus. Many of us can identify as we found it easier to stay home rather than connect with friends and family. Instead of disengaging, she decided to do 60 different things before she turned 60.

If you’re anything like me, you’ve been giving future healthcare considerations serious thought lately. The thing is, life in a long-term care facility or retirement home doesn’t appeal to me. That was when I spoke to Lauren Moses, Vice-President of operations at Home Concierge. Home Concierge, as the name suggests, is devoted to healthcare and good living in the home. Moses suggests that when older adults reach the age of 70, it’s a perfect time to plan ahead and research the types of health care you’d prefer as they age.

No matter how well self-isolating is going, I suggest making a calendar of online events you enjoy with friends and family – or organizations – outside the home. That way, the balancing act between isolation and keeping occupied is met, and you don’t wake up one morning wondering what you did with all that time during the pandemic.

One of the smartest people I know is Rhoda Kopstein. She is definitely the most independent woman, not because she has a Ph.D. in nuclear physics or is a multi-millionaire. It is because she’s lived her life in a way very few have with the courage and the determination to live her best life on her own terms. She is single, never married, nor did she have children, a path she herself chose. Instead, she built a multi-faceted, active life with friends she met at work, in different clubs and associations, everything from aquafit to acting classes to playing bridge. Rhoda’s retirement years didn’t happen by accident. “I planned for retirement for two years before I retired,” she says.

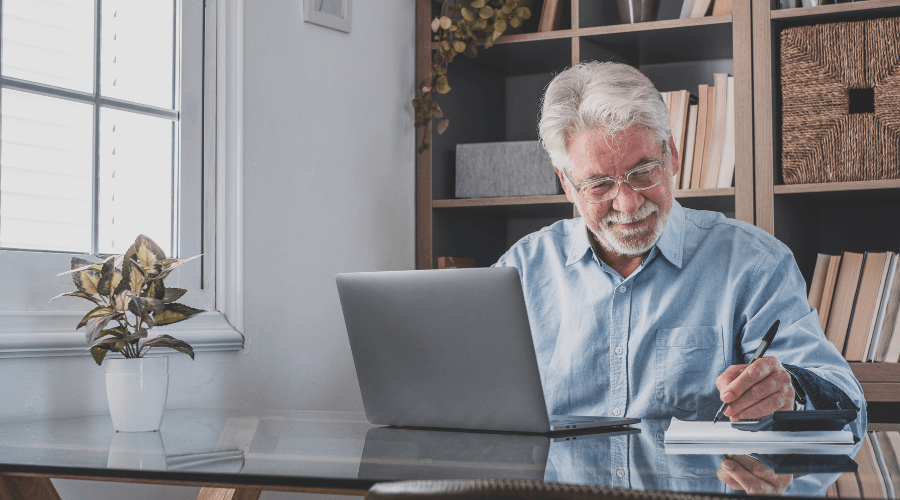

Certain people retire because they’re worn out and want to put their feet up. Others for adventure and travel. Others build their own businesses. Still, others wish to help people. One of those is Kevin Waldbillig who launched his psychotherapist practice after a successful 20-year career in public education as a teacher and school administrator. He was in his mid-forties when he made the big decision. “I like being my own boss,”. Waldbillig’s personal approach helps his clients to become the best version of themselves. In tandem with his clients, his focus is to write a better story for their lives. He describes it this way: “clients move from thoughts to emotions to doing something about their thoughts and feelings.”

Certain people retire because they’re worn out and want to put their feet up. Others for adventure and travel. Others build their own businesses. Still, others wish to help people. One of those is Kevin Waldbillig who launched his psychotherapist practice after a successful 20-year career in public education as a teacher and school administrator. He was in his mid-forties when he made the big decision. “I like being my own boss,”. Waldbillig’s personal approach helps his clients to become the best version of themselves. In tandem with his clients, his focus is to write a better story for their lives. He describes it this way: “clients move from thoughts to emotions to doing something about their thoughts and feelings.”

Early retirement was all the rage, but even back then, while imagining an early retirement, I was concerned that I wasn’t suited to “doing nothing.” Entrepreneurship is a growing trend as baby boomers discover how rewarding a second career can be. A study by CIBC illustrates that the propensity to be self-employed increases with age. Between 15 and 54 years of age, wanting to start a business climbs slowly until it hits 64 years of age, and then the desire to be your own boss increases dramatically. This week I spoke to Allan Dale, who is firing on all cylinders as he grows his consulting business. For Dale, Freedom 55 translates into new careers, inspirational experiences and an active and successful life while ageing.

It’s been weeks since Queen Elizabeth passed away, yet I find myself thinking about her more than I expected and with increasing admiration. I’m curious if others feel the same way I do: that the Queen was a fixture in my life, indomitable and reliable. She became Queen when I was an infant. As Prime Minister Trudeau remarked, “she was Queen almost half of Canada’s existence.’’ Her many appearances here and throughout the Commonwealth marked the coming to adulthood of a generation of Canadians who observed the marriages, divorces, missteps, and follies of her children and now her grandchildren, all the while mirroring shades of our private dilemmas and family divisions. As the Queen and her children aged, we grew older and possibly wiser, along with her.

Challenge Factory focuses on what Taylor calls “talent as equity,” which challenges the typical premise that “people are a company’s greatest assets.” What’s impressive is talent equity replaces the concept of approaching employees as assets, acquired for a price and depreciated over time. Instead, Taylor’s idea is to consider employees as an appreciating asset, as “people equity.” When career and talent programs assume that after employees leave there is no on-going value relationship, older workers and retirees are simply discarded. Instead, Taylor suggests seeing them as alumni or even better, providing opportunities for later-life career changes that leverage experience, while reducing management responsibilities.

I don’t believe there is anyone, anywhere who wants to pay more for their groceries this month than they did the month before. But that’s what is happening in Canada as inflation reached a high of 8.1 percent in June, with food inflation rising to a hefty 9.2 percent in July. The Bank of Canada’s interest rate is at 2.5 percent – with the most significant raise in 20 years. The big banks’ prime rate is 4.7 percent. What’s a retired person on a fixed income to do? I realized that the best option is to try to stick to a financial plan, not dwell on the inflationary prices at the check-out counter, and recognize that older Canadians remain in a privileged position compared to younger folks.

Follow @JoyceWayne1951

Follow @JoyceWayne1951